Foreign Divestiture Decision

Solve the following problem:

Baltimore Co. considers divesting its six foreign projects as of today. Each project will last 1 year. Its required rate of return on each project is the same. The cost of operations for each project is denominated in dollars and is the same. Baltimore believes that each project will generate the equivalent of $10 million in 1 year based on today's exchange rate. However, each project generates its cash flow in a different currency. Baltimore believes that interest rate parity (IRP) exists.

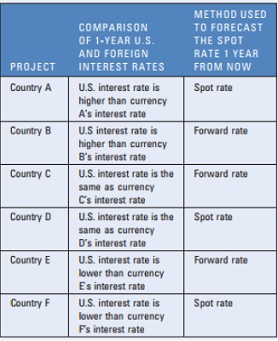

Baltimore forecasts exchange rates as explained in the table below

a. Based on this information, which project will Baltimore be most likely to divest? Why?

b. Based on this information, which project will Baltimore be least likely to divest? Why?