Part 1: Firm Perspective

Source 1: Rising jet fuel prices weigh heavily on Qantas, Virgin Business

Matt O'sullivan

JET FUEL prices will top the list of challenges facing Qantas and Virgin Australia this year as their single biggest expense hovers well above $US120 ($114) a barrel.

Fears of higher fuel costs gained traction this week after the International Monetary Fund warned that crude prices could surge between 20 per cent and 30 per cent if Iran halts oil supplies because of trade sanctions placed on it by the European Union and the US.

Matt Crowe, a transport analyst at CBA Equities, said the possibility of an oil price spike following tensions in the Persian Gulf would ''keep airline CEOs awake at night''.

...Virgin and Qantas last raised fuel surcharges for flights early last year. The latter's most expensive surcharge is $290 for a one-way flight between Australia and Europe. Budget airlines such as Qantas's offshoot, Jetstar, and the Singapore Airlines-backed Tiger Airways are most vulnerable to high fuel prices because fuel makes up a bigger proportion of their total costs. Their passengers are also more sensitive to higher fares and other charges than those who fly on airlines offering a premium service [like Qantas].

Despite the attention drawn by Qantas's bitter battle with unions, analysts at Merrill Lynch say the high cost of fuel was the main issue facing the airline in the first half.

Their calculations show that the price of fuel as a percentage of Qantas's total costs has risen from 14 per cent in 2004 to an expected 28 per cent this financial year.

Jet fuel prices have jumped from an average $US37 a barrel in 2004 to $US125 now. The airlines also face increased costs from the carbon tax, due to come into effect on July 1

Source: https://www.smh.com.au/business/rising-jet-fuel-prices-weigh-heavily-on-qantas-virgin-20120126-1qjm7.html#ixzz3AhcrwQTj

1. Read article above and answer the following questions.

a) How would the rising fuel costs affect the market for Qantas flights? Demonstrate by using a diagram and explain the effect on price and quantity.

b) The rise in fuel costs has affected premium airlines like Qantas and also budget airlines like Tiger airways. Refer to the article and elasticity of demand theory and explain how the increase in fuel prices might affect Qantas and Tiger Airways differently. Use graphs to illustrate your answer

Source 2

Australian Airline Industry

Research Paper Index Research Paper Index Research Paper Index Research Paper Index

Research Paper no. 10 Research Paper no. 10 Research Paper no. 10 Research Paper no. 10 2002 2002 2002 2002- -- -03 0303 03 ...Economic Characteristics of the Airline Industry

Economies of Scale

Parts of the airline industry are characterised by economies of scale. Economies of scale occur when expanding the production of a service results in a lowering of the average cost of its production. The implication of this is that a larger service provider will achieve lower costs than his smaller competitors.

This could be relevant in today's airline industry, with its 'David and Goliath' structure in the form of an emerging, relatively modestly sized and resourced Virgin Blue versus a dominant and well 'cashed-up' Qantas.

... Competition between Qantas and Virgin Blue is arguably more limited than between Qantas and the Ansett group under the former industry structure. Virgin Blue focuses mainly on leisure travel over major trunk routes rather than an integrated trunk and regional network and it offers only one-class service and relatively infrequent flights. In this sense, it is not a comprehensive replacement for the former full-service Ansett operation.

...Qantas is trying to defend its market share through service upgrades and innovations such as the CityFlyer services on key trunk routes.

Virgin Blue's strategy seems to be one of 'cherry picking'that is focusing on a limited number of high-density routes and not operating a more traditional route system of a nationwide network that cross-subsidises less profitable routes. Virgin Blue has also sought to minimise costs through more flexible working arrangements including multi-skilling (relative to past standards and to Qantas), and low overheads (for example not having lounges or catering).

Source:https://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/pubs/rp/rp0203/03RP10#dthe

2. Read the article above and answer the following questions:

a) Based on the article above and some limited research what type of market form you think the airline industry in Australia was in 2002/03? Support your answer with reference to theory.

b) If the airline industry was an oligopoly and Qantas and Virgin could collude, what would be a dominant (Nash equilibrium strategy) that they could adopt with reference to their pricing? Explain your answer with reference to theory.

Part 2: Macroeconomic Perspective

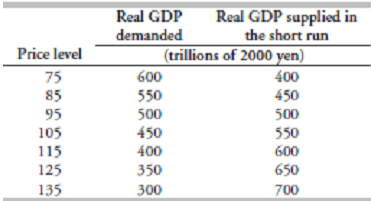

1. In Japan, potential GDP is 600 trillion yen and the table shows the aggregate demand and short-run aggregate supply schedules.

a) What is the short-run equilibrium, real GDP and price level?

b) Does Japan have an inflationary gap or a recessionary gap? What fiscal policy can be used to correct this gap?

2. Using the sources below answer the following questions:

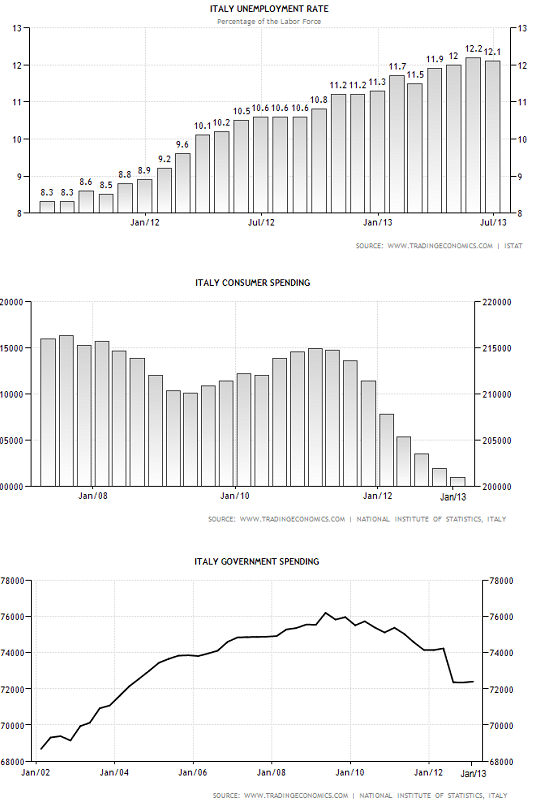

a) What phase of the business cycle was Italy going through in 2012? Refer to the above sources and economic theory in your answer and demonstrate the phase of the business cycle using an aggregate demand and supply model.

b) Based on the sources above and using your aggregate demand and supply model from a) describe what happened to the Italian economy from 2012 to 2013? Explain your answer with reference to theory.

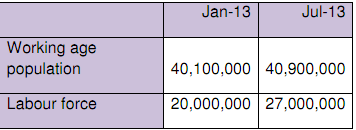

c) What was the unemployment rate in Italy in January 2013 and in July 2013 based on the above graphs? What is the labour force participation rate in Italy in January 2013 and July 2013 according to the below data? What do these statistics tell you how employment in Italy has changed?