Assignment:

1. K&G Co. is evaluating a project that has the following cash flow and WACC data. What is the project's discounted payback period? Show your formula and your work in details.

|

WACC:

|

5.40%

|

|

|

|

|

|

Year

|

0

|

1

|

2

|

3

|

4

|

|

Cash flows

|

-$1040

|

$780

|

$365

|

$450

|

$490

|

2. H&M inc. is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Show your work in details.

|

WACC:

|

6.00%

|

|

|

|

|

|

Year

|

0

|

1

|

2

|

3

|

4

|

|

Cash flows

|

-$5000

|

$6000

|

$-5200

|

$-7500

|

$8000

|

3. Person Co. is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected. You have to use the formula to address this question. No partial credit will be given if you simply use the financial calculator to answer the question.

|

WACC:

|

11.00%

|

|

|

|

|

Year

|

0

|

1

|

2

|

3

|

|

Cash flows

|

-$1050

|

$800

|

$200

|

$550

|

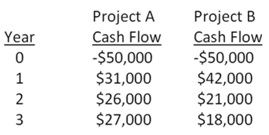

4. T&T is considering two mutually exclusive projects with the following cash flows.

(a) What is the crossover rate? Show your work in details.

(b) If therequired rate of return is lower than the crossover rate, which project should be accepted? Why?

5. To estimate the company's WACC, B&H inc. recently hired you as a consultant. You have obtained the following information.

(1) The firm's noncallable bonds mature in 15 years, have a 7.50% annual coupon, a par value of $1,000, and a market price of $1,110.00.

(2) The company's tax rate is 34%.

(3) The risk-free rate is 2.60%, the market return is 8.50%, and the stock's beta is 1.50.

(4) The target capital structure consists of 35% debt and the balance is common equity. The firm uses the CAPM to estimate the cost of common stock, and it does not expect to issue any new shares. What is its WACC? Show your work in details.

6. AT&T inc is evaluating a new project whose data are shown below. The project has a 4-year tax life and would be fully depreciated by the straight-line method over 4 years, but it would have a positive pre-tax salvage value at the end of Year 4, when the project would be closed down. Also, some new working capital would be required, but it would be recovered at the end of the project's life. Unit sales and fixed costs will be constant, but the sales price and variable cost should increase with inflation. Forecast the corresponding cash flows and determine the value of this project

|

WACC

|

10.00%

|

|

Net investment in fixed assets (depreciable basis)

|

$280,000

|

|

Required new working capital

|

$10,000

|

|

Average price per unit, Year 1

|

$90

|

|

Unit Sold per year

|

90,000 units

|

|

Variable operating cost/unit, Year 1

|

$32

|

|

Fixed Cost each year (not including Depreciation) (constant)

|

$120,000

|

|

Expected pretax salvage value

|

$11,000

|

|

Tax rate

|

35.00%

|

|

Expected inflation rate per year

|

2.40%

|

|

t = 0

|

t = 1

|

t = 2

|

t = 3

|

t = 4

|

|

Inflation

|

|

|

|

|

|

|

Price per unit

|

|

|

|

|

|

|

VC per unit

|

|

|

|

|

|

|

Units sold

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales revenues

|

|

|

|

|

|

|

- Fixed op. cost (excl. deprec.)

|

|

|

|

|

|

|

- Variable op costs

|

|

|

|

|

|

|

- Depreciation

|

|

|

|

|

|

|

Operating income (EBIT)

|

|

|

|

|

|

|

- Taxes

|

|

|

|

|

|

|

After-tax EBIT

|

|

|

|

|

|

|

+ Depreciation

|

|

|

|

|

|

|

Cash flow from Operation

|

|

|

|

|

|

|

Investment in working capital

|

|

|

|

|

|

|

Capital Spending

|

|

|

|

|

|

|

Salvage value, pre-tax

|

|

|

|

|

|

|

- Tax on salvage value

|

|

|

|

|

|

|

Total cash flows

|

|

|

|

|

|

What is the project's NPV and IRR? What decision should be made?