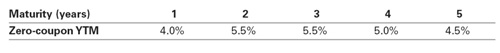

Problems 1–4 refer to the following table:

1.What is the forward rate for year 2 (the forward rate quoted today for an investment that begins in one year and matures in two years)?

2.What is the forward rate for year 3 (the forward rate quoted today for an investment that begins in two years and matures in three years)? What can you conclude about forward rates when the yield curve is flat?

3.What is the forward rate for year 5 (the forward rate quoted today for an investment that begins in four years and matures in five years)?

4.Suppose you wanted to lock in an interest rate for an investment that begins in one year and matures in five years. What rate would you obtain if there are no arbitrage opportunities?

5.Suppose the yield on a one-year, zero-coupon bond is 5%. The forward rate for year 2 is 4%,and the forward rate for year 3 is 3%. What is the yield to maturity of a zero-coupon bond that matures in three years?