Discuss the below:

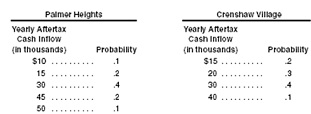

Q1) Five investment alternatives have the attached returns and standard deviations of returns. Using the coefficient of variation, rank the five alternatives from lowest risk to highest risk.

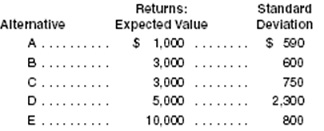

Q2)Mr. Sam Golff desires to invest a portion of his assets in rental property. He has narrowed his choices down to two apartment complexes, Palmer Heights and Crenshaw Village. After conferring with the present owners, Mr Golff has developed the estimates of the cash flows for those properties.

a) Find the expected cash flow from each apartment complex.

b) What is the coefficient of variaion for each apartment complex?

c) Which apartment complex has more risk?