Assignment:

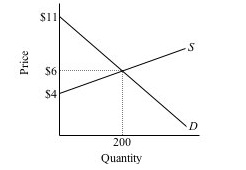

1. Suppose the market for melons can be described by the graph below. Show all work in your answers.

a. If Jon's maximum willingness to pay for a melon is $8, how much surplus per unit is he receiving at the market price of $6?

b. Suppose Figgy Farms requires at least $5 per melon before they will sell in this market. What is Figgy's producer surplus per unit in this market?

c. How much total consumer surplus is received in this market?

d. How much total producer surplus is received in this market?

e. What is the combined surplus in the market?

2. Suppose a competitive firm's cost information is as shown in the table below. Show all work in your answers.

|

Output

|

Marginal Cost

|

Average Variable Cost

|

Average Total Cost

|

|

0

|

|

|

|

|

1

|

$ 8.00

|

$ 8.00

|

$ 17.00

|

|

2

|

7.00

|

7.50

|

12.00

|

|

3

|

6.00

|

7.00

|

10.00

|

|

4

|

5.00

|

6.50

|

8.75

|

|

5

|

6.00

|

6.40

|

8.20

|

|

6

|

7.00

|

6.50

|

8.00

|

|

7

|

8.00

|

6.71

|

8.00

|

|

8

|

9.00

|

7.00

|

8.13

|

|

9

|

10.00

|

7.33

|

8.33

|

|

10

|

11.00

|

7.70

|

8.60

|

a. Suppose the firm sells its output for $9.10. What is the firm's marginal revenue (MR)? Explain.

b. Compare MR to marginal cost (MC) to determine the firm's profit maximizing (loss-minimizing) output level. Be sure to check whether or not the firm should shut down. Show all work & explain your answers well.

c. What is the firm's per-unit profit (loss) and total profit (loss) at this output level? Show all your work.

d. Repeat parts a. through c. assuming the price has fallen to $7.10.

e. Repeat again assuming the price has fallen to $6.10.

f. At what price does the firm earn a normal profit? Explain.

g. At what price must this firm shut down? Explain.