1. Two pollution sources are located in the same town, immediately next to each other. For every quantity of abatement, marginal costs of abatement for the first source are higher than marginal costs of abatement for the second source.

(a) If both the tax and standard achieve the same level of total emissions, is a uniform pollution tax more cost effective than a uniform pollution standard (that is, a tax or a standard that is the same for both sources), less cost effective than a uniform standard, or are you unable to tell? Why?

(b) Would the sources prefer to face a pollution subsidy or a marketable permit scheme, if permits are distributed at no cost based on the standard in (a), and both the subsidy and the permit scheme achieve the same level of total emissions? Why?

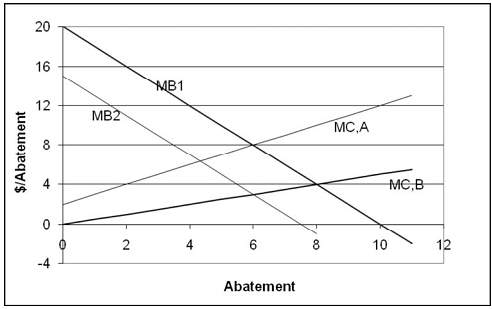

2. In the figure below, MB1 is the marginal benefit that town 1 gets from abatement; MB2 is the marginal benefit for town 2. MC, A is the marginal cost of abatement for source A, and MC, B is the marginal cost of abatement to source B. In both cases, the pollution is local, that is it affects only the city in which the source is located. Use the figure below to answer the following questions.

(a) If source A is located in town 1, what is the efficient level of abatement for town 1? Why?

(b) If source A is located in town 1, what level of pollution tax will achieve the efficient level of pollution for town 1? Why will that level of tax achieve the efficient level?

(c) If source A is in town 1, and if source B is in town 2, is a uniform pollution tax or a uniform pollution standard (that is, a tax or a standard that is the same in both places) more efficient? Why?

(d) If source A is in town 2, and if source B is in town 1, does that change your answer in (c)?