Background:

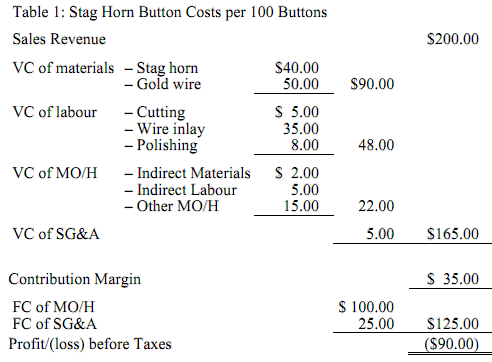

Mr David Buttoner the owner operator of Buttons by David Pty Ltd. runs a number of button lines. His favourite is a cut stag-horn button that has gold filigree. Using a variable costing approach, the revenues and costs per 100 buttons is:

However, that line is not popular with the customers and generates a substantial loss for the company. Currently, the company has 30,000 stag horn buttons in inventory.

Required:

As the External Auditor and using a standard format memo please explain to Mr David Buttoner:

1) The concept of valuing Inventories at the "Lower of Cost or Market",

2) The estimated "full absorption cost" of manufacturing 100 stag horn buttons, and

3) The appropriate value for the stag horn buttons inventory in total and per 100 buttons

- show calculations to justify your answer.