Question 1: John Maynard Keynes argued that the basic problem which led to the world depression was:

a) Inadequate demand for goods and services.

b) The shortage of goods and services.

c) Negative net exports on goods and services.

d) Decreasing supply of goods and services.

Question 2: When an economy is producing a level of output that is higher than the equilibrium level, planned expenditures ________ total output and ________ goods and services are being generated than are being demanded.

a) Exceed; fewer

b) Are less than; more

c) Are less than; fewer

d) Exceed; more

Question 3: When the consumption function is C = 25 + 0.9y and income rises by $100, then consumer spending will rise by:

a) $10.

b) $25.

c) $90.

d) $115.

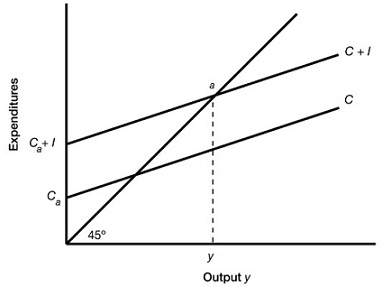

Question 4: Assume that Ca = 40, MPC = 0.8, I = 10. Equilibrium income is:

a) 40.

b) 50.

c) 250.

d) 400.

Question 5: If MPC = 0.75, then the government spending multiplier would be:

a) 0.25.

b) -7.5.

c) 4.

d) 25.

Question 6: The tax multiplier is negative as:

a) Increases in taxes decrease disposable personal income and lead to the reduction in consumption spending.

b) Taxes always have a negative impact on economy.

c) Tax rates are inversely related to the tax revenues.

d) Rises in consumption spending have a negative impact on the tax revenues.

Question 7: When firms receive an economic forecast predicting future raises in the growth of real GDP, they are likely to respond through:

a) Raising their level of investment spending to raise current production capacity.

b) Raising their level of investment spending to raise future production capacity.

c) Reducing their level of investment spending to reduce future production capacity.

d) Reducing their level of investment spending to reduce current production capacity.

Question 8: If you wish for to purchase a new sports car in four years for $75,000, how much would you require having in your bank account now, so after four years you will have $75,000 to buy the car? Suppose that your bank pays 6 percent interest.

a) $51,226

b) $59,408

c) $60,484

d) $70,755

Question 9: Assume that you have $400 and the inflation rate is 5 percent. In order to earn a real return of $16 on your investment, the nominal interest rate requires being near:

a) 0 percent.

b) 4 percent.

c) 6 percent.

d) 9 percent.

Question 10: When a firm wants to finance a new project, it can get financing by:

a) Employing its retained earnings.

b) Selling corporate bonds to public.

c) Issuing and selling new shares of stock.

d) All the above.

Question 11: Financial intermediaries decrease risk by:

a) Gaining expertise in evaluating and monitoring the investments.

b) Investing in a big number of projects with independent returns.

c) Investing in a small number of projects with independent returns.

d) Limiting the diversity of their investment portfolios.

Question 12: In the ________ increases in the supply of money will ________.

a) Short run; increase total demand and output.

b) Short run; reduce total demand and output.

c) Long run; lead to lower prices

d) Long run; increase total demand and output.