You recently joined ‘Arigato’, a Japanese company which owns a chain of sushi restaurants across the state.

The company’s stock is hundred percent owned by its two cofounders and the current market price of each of the 1 million shares of stock is $20.

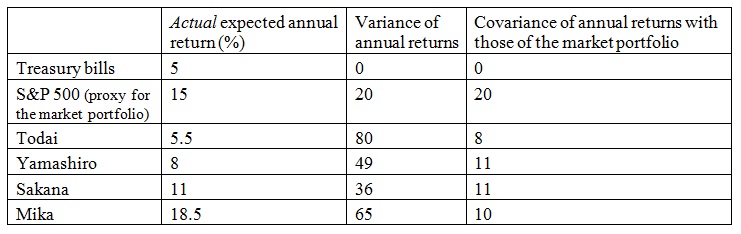

One of your first big assignments at work was working in a team with a few other employees of the company on assessing the level of risk of the company and compare it with that of its competitors in the restaurant business. Your team recognized four main competitors, also owned fully by their respective cofounders: Todai, Yamashiro, Sakana and Mika. The sizes of the four competing companies are comparable to the size of your company. You have found out that the risk of ‘Arigato’ reflects the average risk of the competitors. In your role of financial analysts, you applied your sophisticated finance knowledge and get the following information regarding different financial investments:

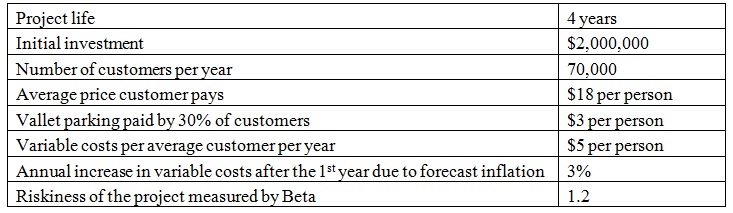

Your most recent assignment is to assess the profitability of a new investment project: opening a new sushi restaurant in Pomona. You were asked to examine the projected revenues and costs and advise the board of directors on the company’s future financial planning. Below is the information about the project:

Corporate income tax rate is 34%. The project equipment (that is, the initial investment) will depreciate on the straight line over 4-years to zero salvage value.

Based on the above information, answer the given questions:

Question 1: Compute the Betas of T-bills, S&P500 and the four competitors. Which one of such has the highest total risk (describe what total risk means)? The highest systematic risk (describe what systematic risk means)? Compute and describe all calculations.

Question 2: You analyzed the company’s performance and made a report for your boss regarding the relative riskiness of the company’s and also of its competitors’ stock returns. In this report you concluded that the expected return on the company’s stock correctly reflects its systematic risk. Based on this, find out the annual rate of return on equity that investors need? Compute and describe.

Question 3: What is the weighted average cost of capital for the proposed investment project? Is the project as risky as the company? Compute both and elucidate your calculations.

Question 4: Would you propose your boss to accept or reject the new sushi restaurant project? Compute the net present value of the proposed project. Describe all calculations.

Question 5: How would the systematic risk of the company change if the project got accepted? For that you can use the information given earlier regarding the company’s current capital structure and the fact that the other $2,000,000 worth of additional equity was raised to cover the initial cost of the project.

Question 6: You and your company’s co-owners decided to do an additional research regarding the possible debt financing of the project. You did some additional computations and came to conclusion that paying for the initial investment of the project with equity alone is not optimal. You believe that financing half of the total initial investment by debt and only half by equity would be a good target debt-equity ratio and that by using it would maximize the value of the new sushi restaurant project. The debt is risk-free and therefore has the same expected return as the risk-free asset. It is interest-only loan that means that it will need annual interest payments for four years, and the principal will be fully repaid at the end of the fourth year.

a) What is the present value of the project by using the Adjusted Present Value (APV) approach? Compute and describe.

b) What is the present value of the project by using the Cash Flow-to-Equity (FTE) approach? Compute and describe.

c) Finally, what would be the present value of the project based on the Weighted Average Cost of Capital (WACC) approach? Compute and describe.

Question 7: Would your answers to Question 6-(a), (b), (c) change if the debt instead looked like a four-year amortizing loan, with fixed total annual payments in all four years? (You can review what amortizing loans appear like in Ross, Westerfield, Jordan textbook which you used in FRL300 class, or you can use other sources.) Describe and show all computations and also what changes in your answers to 6-(a), (b), and (c), where essential.