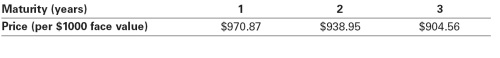

1.Prices of zero-coupon, default-free securities with face values of $1000 are summarized in the following table:

Suppose you observe that a three-year, default-free security with an annual coupon rate of 10% and a face value of $1000 has a price today of $1183.50. Is there an arbitrage opportunity? If so,show specifically how you would take advantage of this opportunity. If not, why not?

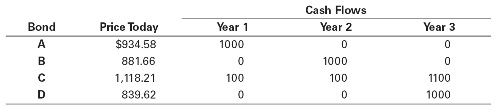

2.Assume there are four default-free bonds with the following prices and future cash flows:

Do these bonds present an arbitrage opportunity? If so, how would you take advantage of this opportunity? If not, why not?