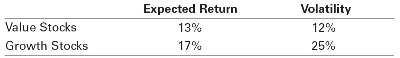

1.Suppose you group all the stocks in the world into two mutually exclusive portfolios (each stock is in only one portfolio): growth stocks and value stocks. Suppose the two portfolios have equal size (in terms of total value), a correlation of 0.5, and the following characteristics:

The risk free rate is 2%.

a. What is the expected return and volatility of the market portfolio (which is a 50–50 combination of the two portfolios)?

b. Does the CAPM hold in this economy? (Hint : Is the market portfolio efficient?)

2.Suppose the risk-free return is 4% and the market portfolio has an expected return of 10% and a volatility of 16%. Johnson and Johnson Corporation (Ticker: JNJ) stock has a 20% volatility and a correlation with the market of 0.06.

a. What is Johnson and Johnson’s beta with respect to the market?

b. Under the CAPM assumptions, what is its expected return?

3.Suppose Intel stock has a beta of 2.16, whereas Boeing stock has a beta of 0.69. If the risk-free interest rate is 4% and the expected return of the market portfolio is 10%, what is the expected return of a portfolio that consists of 60% Intel stock and 40% Boeing stock, according to the CAPM?

4.What is the risk premium of a zero-beta stock? Does this mean you can lower the volatility of a portfolio without changing the expected return by substituting out any zero-beta stock in a portfolio and replacing it with the risk-free asset?