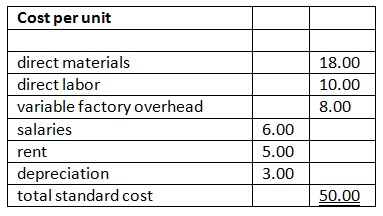

Stopover industries ltd, a recently incorporated company plans to go into production next year. The given standard cost matrix has been assembled for one of the products it recommends to manufacture.

The given information is available:

1) The company anticipates manufacturing 198,000 units in the 2000 fiscal year.

2) Sales in the second and fourth quarters of the year are expected to be twice those of the first and third quarters.

3) Direct materials are ordered and for, a month in advance.

4) 20% of the company sales are in cash. 60% of the credit sales are collected in the month following the month of sales and the balance the given month.

5) Expenditures are settled in arrears at the month end.

6) Overdraft facilities have been agreed at 30% per quarter and the company's bank balance at 31 December 19x9 is expected to be 50,000.

7) The product is predicted to retail at 80 per unit.

REQUIRED:

Question 1: Budgeted profit and loss for the first quarter?

Question 2: Sales collection and schedule for the months of January, February & March 2000?

Question 3: Cash flow for the months of Jan, Feb and Mar 1999?