Section-A:

Question 1: Discuss in short the various GAAPs which are mandatory to be followed.

Question 2: What are the different components of total cost?

Question 3: What are the statements of financial information? Explain two items from each.

Question 4: Describe statement of changes in financial positions, with an illustration.

Section-B:

Case Study:

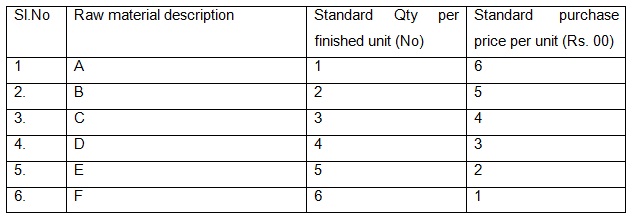

M/s XYZ Ltd manufactures a product ‘PLVS’ at its plant at Meerut, the maximum capacity of which is 200 units per month. Details of raw materials which go into the making of 1 unit of ‘PLVS’ are given below:

Standard fixed overheads are Rs. 20,00,000/- per month while the standard variable overhead rate has been estimated as equal to Rs.1,400/- per unit of finished goods.

You are required to calculate the following:

a) Standard cost of the product.

b) Calculate the production volume variance in case the company produces and sells only 100 units of finished goods in the concerned month.

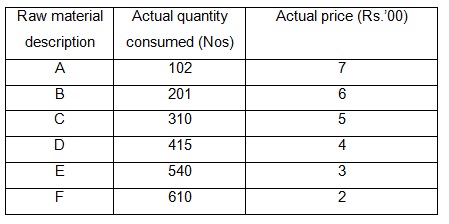

c) Calculate the usage and material price variances considering the given actual data (actual production and sale: 100 units)

d) Supposing no deviation in the actual selling price (Rs. 30,000/-) and the actual overheads from what was projected in Standards, you are needed to calculate the actual profits.