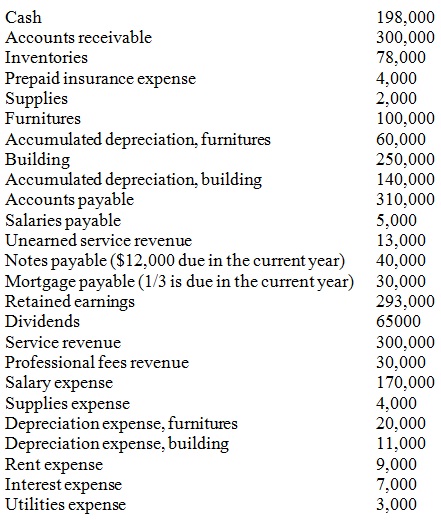

PROBLEM A:

Below is the Trial Balance for Clay Employment Services, year ending December 31, 2011. Previous period’s information were as follows: net receivables, $290,000 and inventory, $82,000. Total revenues were $350,000 for 2010, 360,000 for 2009, and 295,000 for 2008.

Requirements:

1) Prepare the income statement, statement of retained earnings, and balance sheet.

2) Calculate the following ratios: current ratio, quick ratio, debt ratio, accounts receivable turnover, and inventory turnover. Briefly explain your answers.

3) Calculate the vertical analysis for total current assets.

4) Calculate the horizontal analysis on total revenues from 2008 thru 2011.

PROBLEM B:

ABC Corporation accountants have assembled the following data for the year ended December 31, 2007.

REQUIRED:

Prepare ABC Corporation’s statement of cash flows using the indirect method. Include an accompanying schedule of noncash investing and financing activities.

12/31/07 12/31/06

Current Accounts:

Current assets:

Cash and cash equivalents $85,000 $22,000

Accounts receivable 69,200 64,200

Inventories 80,000 83,000

Current liabilities:

Accounts payable $57,800 $55,800

Income tax payable 14,700 16,700

Transaction data for 2007:

Net income $ 57,000 Purchase of treasury stock $14,000

Issuance of common stock for cash 41,000 Loss on sale of equipment 11,000

Depreciation expense 21,000 Payment of cash dividends 18,000

Purchase of building 125,000 Issuance of long-term note

Retirement of bonds payable by payable to borrow cash 34,000

Issuing common stock 65,000 Sale of equipment 58,000

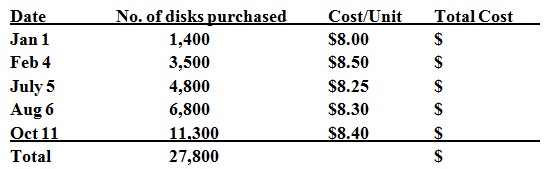

PROBLEM C:

At the beginning of the current year, MegaSounds opened a music store that sells compact disks. At the end of the year, a physical inventory count revealed that 2,500 of those disks are on hand.

Required:

1) Calculate the total cost for each purchase date.

2) Calculate the ending inventory using (a) FIFO, (b) LIFO, and Average Cost methods.

PROBLEM D: Machinery purchased on January 1, 2011:

Cost of machinery 250,000

Estimated residual value 10,000

Estimated useful life:

Years 6 years

Units of production 200,000 machine hours

Required:

Calculate depreciation at each year end that applies:

1) Straight-line method.

2) Units of production method.

Assumption: Machinery machine hours on the 1st year, 66,000; 2nd year, 60,000; 3rd year, 38,000; 4th year, 22,000; 5th year, 8,000; and 6th year, 6,000

3) Double-declining method.