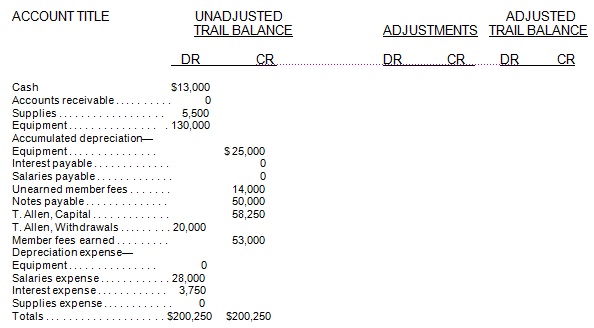

Problem: Complete the six-column table by entering adjustments that reflect the following information:

1. As of December 31, 2005, employees had earned $900 of unpaid and unrecorded salaries. The next payday is January 4, at which time $1,600 of salaries will be paid.

2. The cost of supplies still available at December 31, 2005, is $2,700.

3. The notes payable requires an interest payment to be made every three months. The amount of unrecorded accrued interest at December 31, 2005, is $1,250. The next interest payment, at an amount of $1,500, is due on January 15, 2006.

4. Analysis of the unearned member fees account shows $5,600 remaining unearned at December 31, 2005.

5. In addition to the member fees included in the revenue account balance, the company has earned another $9,100 in unrecorded fees that will be collected on January 31, 2006. The company is also expected to collect $8,000 on that same day for new fees earned in January 2006.

6. Depreciation expense for the year is $12,500.

The following six-column table for Bullseye Ranges includes the unadjusted trial balance as of December 31, 2005.