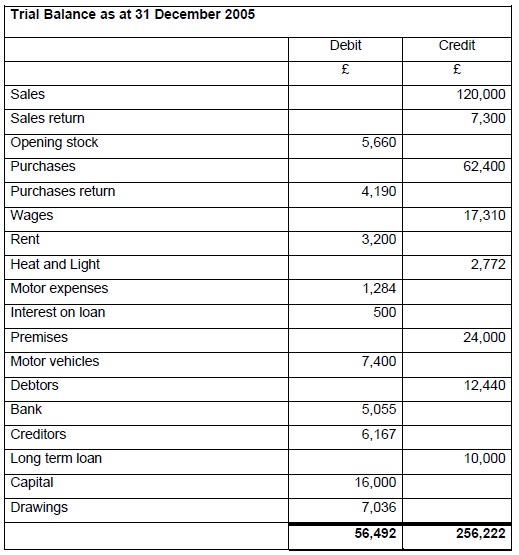

Question 1) Mr Morgan, a sole trader, extracted the following trial balance from his books at the close of business on 31st December 2005. Trial balance fails to agree.

Further information:

1. Closing stock is valued at £ 8,000

2. Rent paid in advance at end of year amounts to £ 800

3. Wages accrued amounts to £ 558 at 31 December

4. Heating and light due at year end is £ 328

5. Interest on Long term loan is 7.5% p.a.

Required:

(a) A corrected Trial Balance as at 31st December 2005

(b) A Trading and Profit and Loss account for the year ended 31st December 2005.

(c) A Balance Sheet as at 31st December 2005

(d) Distinguish, with the help of suitable examples, between capital and revenue expenditure.

(e) What is the significance of the prudence concept in accounting?