An individual with $10,000 to invest has identi?ed three mutual funds as attractive opportunities. Over the last ?ve years, dividend payments (in cents per dollar invested) have been as shown in Table 5, and the individual assumes that these payments are indicative of what can be expected in the future. This particular individual has two requirements:

(1) the combined expected yearly return from his/her investments must be no less than $800 (the amount $10,000 would earn at 8 percent interest) and (2) the variance in future, yearly, dividend payments should be as small as possible. How much should this individual invest in each fund to achieve these requirements?

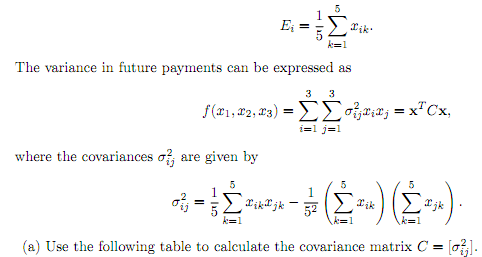

[Hint: Let xi(i =1, 2, 3) designate the amount of funds to be allocated to investment i, and let xik denote the return per dollar invested from investment i during the kth time period in the past (k =1, 2,..., 5). If the past history of payments is indicative of future performance, the expected return per dollar from investment i is

(b) Set up a quadratic optimization problem that will determine the best investment mix.

(c) Solve the problem using the MATLAB quadratic optimization routine quadprog. Interpret your results.