Question 1: Explain the steps comprised in the Investment Process.

Question 2: Write a short note on the management of Stock Exchanges?

Question 3: What are the various types of Securities Markets? What are their role and Functions?

Question 4: Define the term Fundamental Analysis. Bring out its relevance Foreginty Investment Decision?

Question 5: What are the various methods of Quantitative Analysis for equity investment decision? How do they distinct from Qualitative Analysis?

Question 6: What do you mean the statement ‘Capital markets are Efficient’? And why Capital market must be efficient?

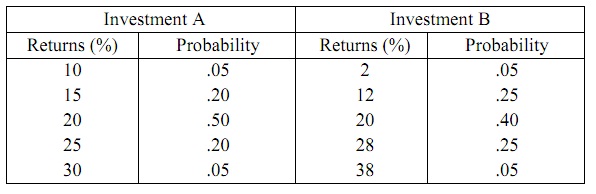

Question 7: The given forecasts have been made for investments A and B.

Compute the expected rate of return and Standard Deviation which investment has more upside potential and down side danger?

Question 8: Rose is considering the purchase of a bond currently selling at Rs. 978.50. The bond has four years to maturity, face value of Rs. 1000 and 7 % coupon rate. The next annual interest payment is due after one year from nowadays. The required rate of return is 10 %.

Question 9: Why does the need occur for Portfolio Revision? What are the constraints in Portfolio Revision?

Question 10: Explain different types of schemes issued by some Mutual Funds?