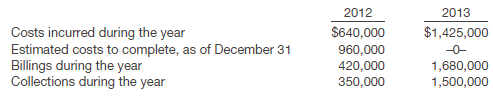

Hamilton Construction Company uses the percentage-of-completion method of accounting. In 2012, Hamilton began work under contract #E2-D2, which provided for a contract price of $2,200,000. Other details are as follows.

�

Instructions

(a) What portion of the total contract price would be recognized as revenue in 2012? In 2013 ?

(b) Assuming the same facts as those shown on page 1139 except that Hamilton uses the cost-recovery method of accounting, what portion of the total contract price would be recognized as revenue in2013?