Response to the following problem:

Polarscape Snow Services Ltd. was incorporated on December 1, 2015 and had the following transactions during its first month of operations.

Dec.

1 Issued share capital for $6,000 cash

1 Purchased a used truck for $9,000: paid $4 ,000 cash, balance due January 15

2 Purchased a $2,000 snowplough on credit to be attached to the truck (record as an increase in the cost of the truck)

5 Purchased salt, sand, and gravel on credit for $500 (recorded as an asset, unused supplies)

6 Paid truck operating expenses of $200

7 Paid $360 for a one-year truck insurance policy effective December 1 (record as an asset, prepaid expense)

14 Paid $1,500 in wages for two weeks

16 Paid $40 traffic ticket (record as truck operating expense)

20 Received a bill for $350 of truck repairs

24 Purchased tire chains on credit for $100 (recorded as truck operating expense)

24 Collected $3,500 of the amount billed December 3

27 Paid for the purchase made on December 5

28 Collected $400 for snow removal performed today for a new customer

28 Paid $1,500 in wages for two weeks

30 Called customers owing $1,500 billed December 3

31 Transferred the amount of December's truck insurance ($30) to insurance expense

31 Counted $100 of salt, sand, and gravel still on hand (record the amount used as supplies expense)

31 Recorded unpaid wages for three days applicable to December in the amount of $450

31 Billed customers $5,000 for December snow removal

31 Paid $200 dividend in cash.

Required:

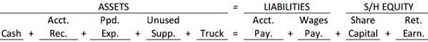

1. Record the above transactions on a transactions worksheet and calculate the total of each column at the end of December. Use the following headings on your worksheet.

2. Prepare an income statement and a statement of changes in equity for the month-ended December 31, 2015, and a balance sheet at December 31. Identify the revenue as "Service Revenue". Record the expenses in alphabetical order.