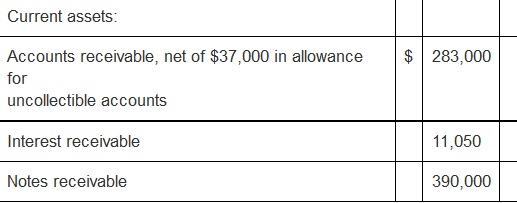

Chamberlain Enterprises Inc. reported the following receivables in its month December 31, 2013, year-end balance sheet:

Additional information:

1. The notes receivable account comprises two notes, $65,000 note and $325,000 note. The $65,000 note is dated October 31, 2013, with principal and interest payable on October 31, 2014. The $325,000 note is dated June 30, 2013, with principal and 6% interest payable on June 30, 2014.

2. Throughout 2014, sales revenue totalled $1,470,000, $1,345,000 cash was gathered from customers and $35,000 in accounts receivable was written off. All sales are made on a credit basis. Bad debt expense is recorded at year-end by adjusting the allowance account to an amount equivalent to 10% of year-end accounts receivable.

3. On March 31, 2014, the $325,000 note receivable was discounted at the Bank of Commerce. The bank's discount rate is 8%. Chamberlain accounts for the discounting as a sale.

Required:

1. In addition to sales revenue, what expense and revenue amounts related to receivables will appear in Chamberlain’s 2014 income statement?

2. What amounts will appear in the 2014 year-end balance sheet for accounts receivable?

3. Compute the receivables turnover ratio for 2014.