Question 1

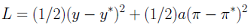

Consider the following function for the social welfare loss:

where y denotes output, y the target level of output, π the rate of inflation and the target rate of Π* inflation.

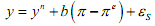

The aggregate supply equation is given by

where yn denotes the natural level of output.

a) Derive the inflation rate that minimizes the loss function under discretion. Derive the corresponding equation for output. Derive the welfare loss that corresponds with discretionary policies.

b) Now derive the inflation rate that minimizes the loss function under commitment (rules). Derive the corresponding welfare loss. Comment on the differences between the results for discretion and commitment.

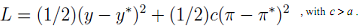

c) Now assume that a central banker is appointed with the task of minimizing the following loss function:

Answer the same questions as under a).

Answer the same questions as under a).

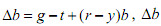

d) Now assume that the aggregate supply equation is given by

Derive again reduced-form expressions for the inflation rate and for output. Discuss how stabilization policies are reflected in these equations and how the effectiveness of stabilization policies relates to the coefficients a and b.

Question 2

Assume that the debt-to-GDP ratio b of a country is 90% GDP The inflation rate is 1% and the nominal interest rate is 3%. The GDP growth rate y is 1%. Its primary deficit (g - t ) is equal to 2% of GDP. The dynamics of debt are described b

is the change in the debt-to-GDP ratio and r is the real interest rate

is the change in the debt-to-GDP ratio and r is the real interest rate

a) Compute the change in the debt-to-GDP ratio using the formula that describes its accumulation for five years ahead.

b) Is the initial level of debt, 90%, sustainable? If not, what is the sustainable level of debt?

c) Assume that the nominal interest rate rises to 10%. Derive the level of inflation that could guarantee the sustainability of debt. What do you conclude?

d) Do you think that monetary policy should cooperate with fiscal policy? If so, why? How could their joint actions affect the level of the debt-to-GDP ratio?