Question 1

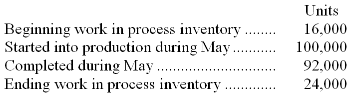

Lowler Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month are listed below:

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

The cost of ending work in process inventory in the first processing department according to the company's cost system is closest to:

Answer

$102,383

$71,668

$31,711

$10,238

Question 2

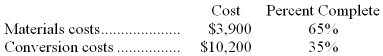

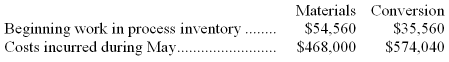

Ermoin Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 600 units. The costs and percentage completion of these units in beginning inventory were:

A total of 5,700 units were started and 4,700 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending inventory was 75% complete with respect to materials and 20% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

The total cost transferred from the first processing department to the next processing department during the month is closest to:

Answer

$265,800

$242,055

$324,456

$251,700

Question 3

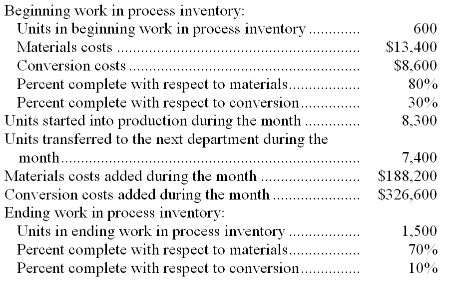

Moulgadi Corporation uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month are listed below:

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

The cost per equivalent unit for materials for the month in the first processing department is closest to:

Answer

$23.28

$21.83

$23.96

$19.70

Question 4

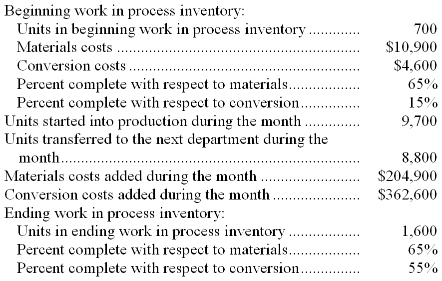

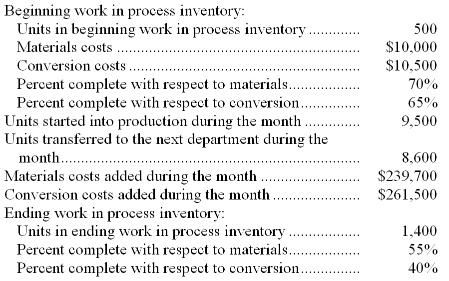

Kimbeth Manufacturing makes Dust Density Sensors (DDS), a safety device for the mining industry. The company uses a process costing system and has only a single processing department. The following information pertains to operations for the month of May:

The beginning work in process inventory was 60% complete with respect to materials and 20% complete with respect to conversion costs. The ending work in process inventory was 90% complete with respect to materials and 40% complete with respect to conversion costs. The costs were as follows:

Using the FIFO method, the cost per equivalent unit of materials for May is closest to:

Answer

$4.12

$4.50

$4.60

$4.80

Question 5

Unizat Corporation uses the weighted-average method in its process costing system. The following information pertains to one of the company's processing departments for a recent month:

All materials are added at the beginning of the process. The cost per equivalent unit for materials is closest to:

Answer

$0.86

$0.90

$1.10

$1.18

Question 6

In November, one of the processing departments at Rullo Corporation had beginning work in process inventory of $23,000 and ending work in process inventory of $32,000. During the month, $267,000 of costs were added to production and the cost of units transferred out from the department was $258,000. The company uses the FIFO method in its process costing system. In the department's cost reconciliation report for November, the total cost to be accounted for would be:

Answer

$580,000

$557,000

$290,000

$55,000

Question 7

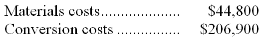

Osman Corporation uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month are listed below:

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

What are the equivalent units for conversion costs for the month in the first processing department?

Answer

8,100

560

8,835

10,000

Question 8

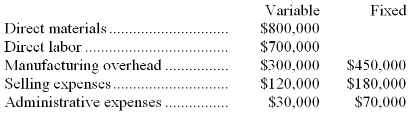

Forest Corporation has prepared the following budgeted data based on a sales forecast of $3,000,000:

What would be the amount of dollar sales at the break-even point?

Answer

$1,125,000

$2,000,000

$2,650,000

$1,750,000

Question 9

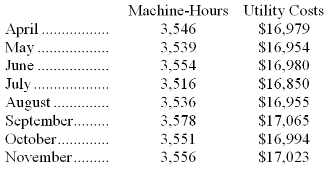

Meleski Corporation's recent utility costs are listed below:

Management believes that utility cost is a mixed cost that depends on machine-hours.

Using the least-squares regression method, the estimate of the variable component of utility cost per machine-hour is closest to:

Answer

$4.40

$4.79

$3.47

$3.37

Question 10

Fenestre Corporation's contribution margin ratio is 25%. The company's break-even is 80,000 units and the selling price of its only product is $4.00 a unit. What are the company's fixed expenses?

Answer

$80,000

$320,000

$20,000

$120,000

Question 11

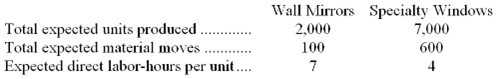

The controller of Hallowell Company estimates the amount of materials handling overhead cost that should be allocated to the company's two products using the data that are given below:

The total materials handling cost for the year is expected to be $18,257.40.

If the materials handling cost is allocated on the basis of material moves, how much of the total materials handling cost would be allocated to the specialty windows? (Round off your answer to the nearest whole dollar.)

Answer

$9,129

$6,639

$14,296

$15,649

Question 12

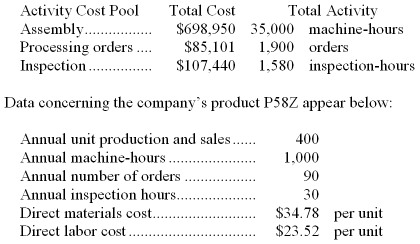

Vodopich Corporation has provided the following data from its activity-based costing system:

According to the activity-based costing system, the average cost of product P58Z is closest to:

Answer

$113.33 per unit

$58.30 per unit

$123.40 per unit

$118.30 per unit

Question 13

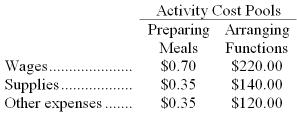

Grodin Catering uses activity-based costing for its overhead costs. The company has provided the following data concerning the activity rates in its activity-based costing system:

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 180 meals were served. The company catered the function for a fixed price of $15.00 per meal. The cost of the raw ingredients for the meals was $9.65 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost; supplies and raw ingredients as a Green cost; and other expenses as a Red cost.

Suppose an action analysis report is prepared for the function mentioned above. What would be the "red margin" in the action analysis report? (Round to the nearest whole dollar.)

Answer

$231

$381

$131

$81