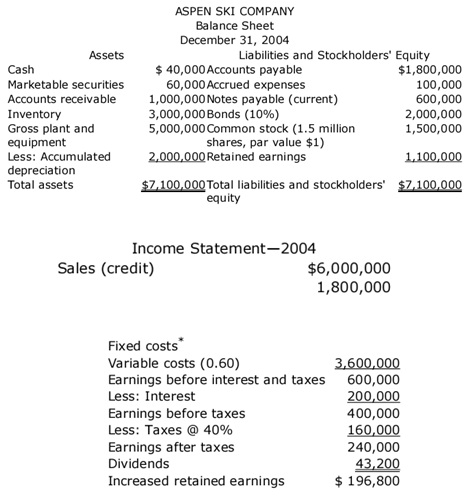

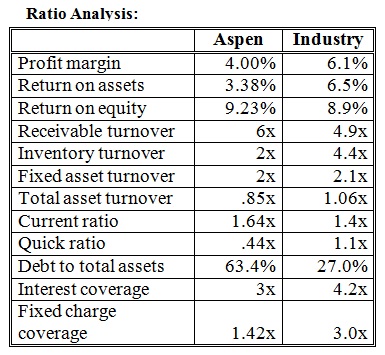

You are a banker for XYZ bank in Buffalo. Your sister in law owns Aspen Ski resort. She has approched you about securing a loan for the addition of more resort condos. She has provided you information in the attached appendix for your analysis about the feasibility of making the loan to her company, Aspen Ski resort. You are writing up a written assessment of the company based on this information.

In your assessment you will need to provide the following information:

Select three promising ratios and explain what they mean.

Select three troubling ratios and explain what they mean.

Based on your ratio analysis, provide rational as to why you would or would not present this proposal to the bank's loan committee.