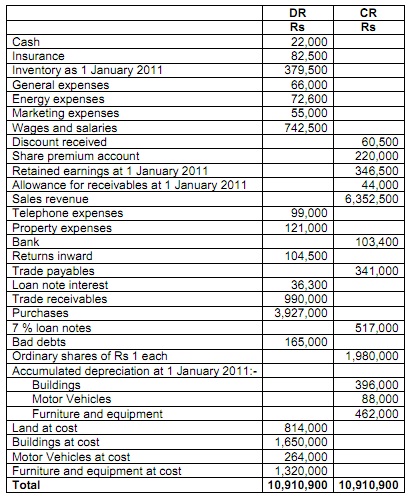

The given information has been extracted from the books of Colombo, a limited liability company as at 31 December 2011.

You have been given with the information below:

1) Inventory at 31 December 2011 was valued at Rs 280,000 based on its original cost. Though, Rs 55,000 of this inventory has been damaged and the directors have agreed to value it for Rs 20,000.

2) The marketing expenses comprise Rs 4,000 that relates to February 2012.

3) Based on the past experience the allowance for receivables is to be raised to 5 % of the trade receivables.

4) There are wages and salaries outstanding of Rs 30,000 for the year ended 31 December 2011.

5) Buildings are depreciated at 5 % of cost. At 31 December 2011 the buildings were professionally valued at Rs 1,800,000 and the directors wish this valuation to be incorporated to the accounts.

6) Depreciation is to be charged as shown:

a) Motor vehicles at 10 % of written down value.

b) Furniture and equipment at 5 % of cost.

7) No dividends have been paid or declared.

8) Tax of Rs 130,000 is to be given for the year.

Required:

Question 1: Make an income statement for the year ended 31 December 2011 and a statement of financial position as at that date, as per the IAS 1 Presentation of Financial Statements.

Question 2: Distinguish between a provision and a reserve.

Question 3: Describe in brief the terms profitability and liquidity.