Task: The following is a list of four projects that Capital Corporation must choose from for the coming year:

Project Project Price Annual Net Inflows

A 700,000 118,861

B 670,000 109,039

C 184,000 32,549

D 273,000 48,305

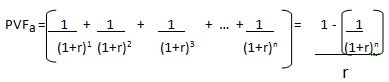

Question 1: Given a uniform rate of interest of 9% and a uniform life of the projects of 10 years each, calculate the NPVs of each Project (To calculate NPV, calculate the Present Value of a 10 year annuity, and subtract the project price. The formula for the present value factor of an annuity is given below where r is the rate of interest and n is the number of years. To get the present value of the stream of annuities multiply the PVF by the amount you get each year.)

Question 2: Why should we choose either Projects A,C, D or Projects A, B, D?