Instructions:

• Read the background information and answer required questions a and b.

• Make sure you note what year is being requested.

• You might use written resources for this project like– the textbook.

Background Information:

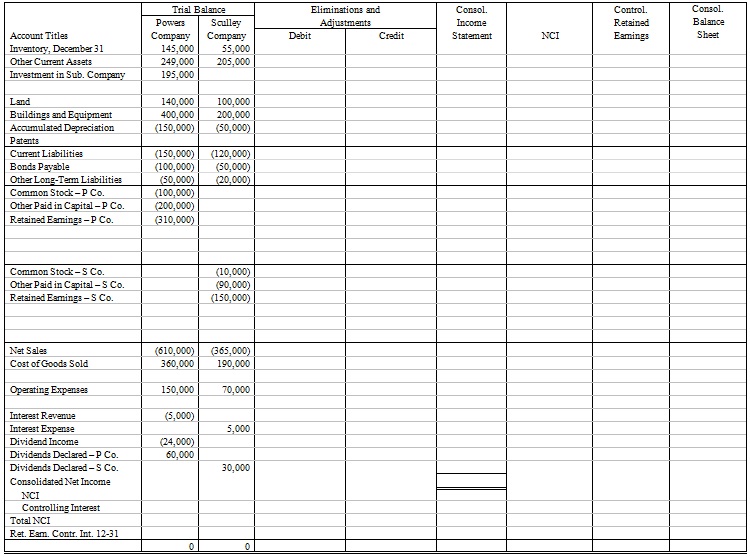

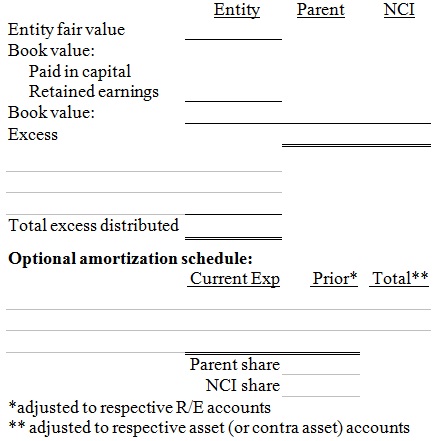

On January 1, 20X1, Powers Company obtained 80% of the common stock of Sculley Company for $195,000. On this date Sculley had total owners' equity of $200,000 (common stock, other paid-in capital, and retained earnings of $10,000, $90,000, and $100,000 respectively).

Any excess of cost over book value is attributable to inventory (worth $6,250 more than cost), to equipment (worth $12,500 more than book value), and to patents. FIFO is used for inventories. The equipment has a remaining life of five years and straight-line depreciation is used. The excess to the patents is to be amortized over 20 years.

On July 1, 20X2 Sculley borrowed $100,000 from Powers with a 10% 1-year note; interest is due at maturity.

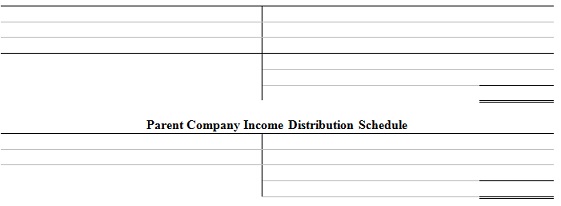

On January 1, 20X2, Powers held merchandise acquired from Sculley for $10,000. During 20X2, Sculley sold merchandise to Powers for $50,000, $20,000 of that is still held by Powers on December 31, 20X2. Sculley's general gross profit on affiliated sales is 50%.

On December 31, 20X1, Powers sold equipment to Sculley at the gain of $10,000. During 20X2, the equipment was used by Sculley. Depreciation is being calculated using the straight-line method, a five-year life, and no salvage value.

Both companies have a calendar-year fiscal year.

Suppose that during 20X1 and 20X2, Powers has suitably accounted for its investment in Sculley using the cost method.

Required:

a. Using the information above, prepare a determination and distribution of excess schedule.

b. Complete the income and distribution schedule.

c. Complete the worksheet for consolidated financial statements for the year ended December 31, 20X2.