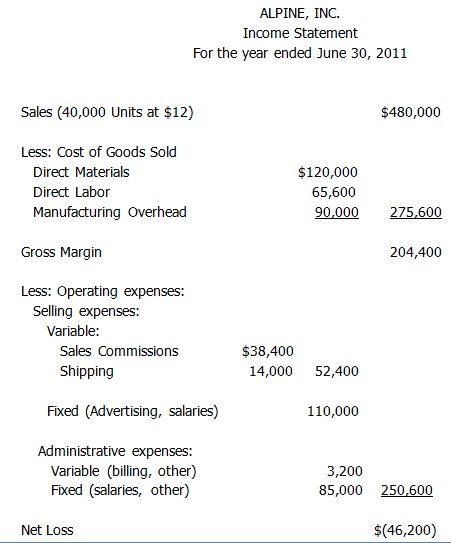

Data: Alpine, Inc., has been experiencing losses for some time, as shown by its most recent income statement:

All variable expenses in the company differ in terms of units sold, except for sales commissions, which are based on sales dollars. Variable manufacturing overhead is 50 cents per unit. The company’s plant has a capacity of 70,000 units.

Management is specifically disappointed with 2011’s operating results. Some possible courses of action are being studied to find out what should be done to make 2012 profitable.

REQUIRED:

1) Redo Alpine, Inc.’s 2011 Income Statement in the contribution format. Show both a total column and a per unit column on your statement.

2) In an effort to make 2012 profitable, Micah Patdu, the president is considering two proposals prepared by members of her staff:

a) Jon Michael, the sales manager would like to decrease the unit selling price by 25 %. He is certain that this would fill the plant to capacity.

b) Mary Wilkinson, the executive vice president would like to raise the unit selling price by 25 %, increase the sales commissions to 12 % of sales, and increase advertising by $90,000. Based on experience in another company, she is confident this would trigger a 50 % increase in unit sales.

Make two contribution income statements, one showing what profits would be under Jon Michael’s proposal and one showing what profits would be under Mary Wilkinson’s proposal. On each statement, comprise both total and per unit columns (don’t show per unit data for fixed costs)

3) Refer to the original data. Micah Patdu, the president thinks it would be unwise to change the selling price. Rather, she wants to use less costly materials in manufacturing units of product, thus reducing costs by $1.73 per unit. How many units would have to be sold during 2012 to earn a target profit of $59,000 for the year?

4) Refer to the original data. Alpine, Inc.’s advertising agency thinks that the problem lies in insufficient promotion. By how much can advertising be increased and still allow the company to earn a target return of 4.5 % on sales of 60,000 units?

5) Refer to the original data. Suppose that the company was approached by an overseas distributor who wanted to purchase 15,000 units on a special price basis during June 2011. There would be no sales commission on these units. Though, shipping costs would increase by 80 % per unit, and variable administrative costs would be decreased by 50 % per unit on these “special order” units. In addition, Alpine, Inc., would have to pay a foreign import duty of $3,150 on behalf of the overseas distributor in order to get the goods into the country. Given these data, what unit price would have to be quoted on the 15,000 units by Alpine,

Inc., to permit the company to earn an ‘overall’ profit of $18,000 for the year ended June 30, 2011 on total operations? Regular business would not be disturbed by this special order.