On 1 July 2009 ABC Ltd get 85% of the share capital of XYZ Ltd by issuing the 110,000 shares. The market price of ABC Ltd shares at the date it obtained control was $3.20 per share. The market price of XYZ Ltd shares at the date ABC Ltd received was $2.60. The date of acquisition equity of XYZ Ltd comprised of:

Share Capital $150,000

General reserve $22,000

Retained earnings $50,000

All the identifiable assets and liabilities of XYZ Ltd were recorded at fair value apart from for the inventory with the carrying amount of $60,000 has the fair value of $180,000.

The inventory was sold outside the group for $250,000 on 30 June 2010.

The inventory of XYZ Ltd on 1 July 2010 comprised inventory purchased from ABC Ltd for $50,000. The original cost of the inventory was $35,000. The inventory was sold outside the group in November 2010.

On 15 March 2011 XYZ Ltd sold inventory to ABC Ltd for $40,000. The original cost of inventory was $33,000. 38 percent of the inventory had been sold outside the group by 30 June 2011.

On 1 January 2011 XYZ Ltd sold an item of plant to ABC Ltd for $22,000. The carrying amount at the time of sale was $36,000 (cost was $80,000). At the time of the sale the asset had a remaining useful life of 5 years.

ABC Ltd uses the proportionate interest goodwill method. The goodwill is not considered impaired.

On 1 July 2011 XYZ Ltd recorded $17,000 as a management fee expense in relation to services given by ABC Ltd. Included in the amount recorded as an expense $3,000 remains unpaid as at 30 June 2011.

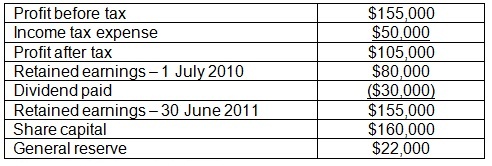

The financial statements of XYZ Ltd for the year ended 30 June 2011 showed:

Required:

1) Prepare an acquisition analysis,

2) Prepare all the consolidation adjustment entries needed to prepare the consolidated financial statements as at 30 June 2011. Give a brief heading for each adjustment that you made.

3) Compute the NCI share of profit for the year ended 30 June 2011

4) Compute the NCI share of shareholders’ equity for the year ended 30 June 2011