Question: Weltin Industrial Gas Corporation supplies acetylene and other compressed gases to industry. Data regarding the store's operations follow:

• Sales are budgeted at $390,000 for November, $370,000 for December, and $380,000 for January.

• Collections are expected to be 90% in the month of sale, 5% in the month following the sale, and 5% uncollectible.

• The cost of goods sold is 60% of sales.

• The company purchases 70% of its merchandise in the month prior to the month of sale and 30% in the month of sale. Payment for merchandise is made in the month following the purchase.

• Other monthly expenses to be paid in cash are $21,800.

• Monthly depreciation is $18,000.

• Ignore taxes.

Required:

Q1. Prepare a Schedule of Expected Cash Collections for November and December.

Q2. Prepare a Merchandise Purchases Budget for November and December.

Q3. Prepare Cash Budgets for November and December.

Q4. Prepare Budgeted Income Statements for November and December.

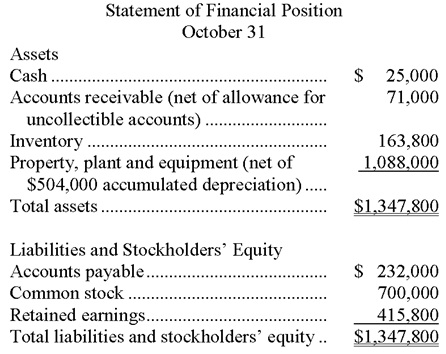

Q5. Prepare a Budgeted Balance Sheet for the end of December.