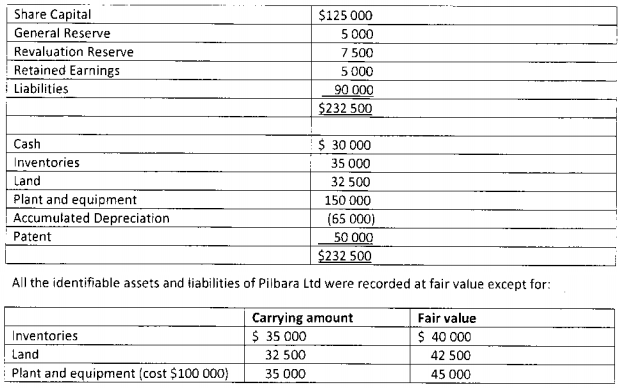

On 1 July 2011, Geraldton Ltd acquired 80% of the share capital of Pilbara Ltd for $132 400. On that date, the statement of financial position of Pilbara Ltd consisted of:

The plant and equipment had a further 5-year life and is depreciated on a straight line basis. The differences between carrying amounts and fair value on acquisition date are adjusted on consolidation. Geraldton Ltd uses the partial consideration method.

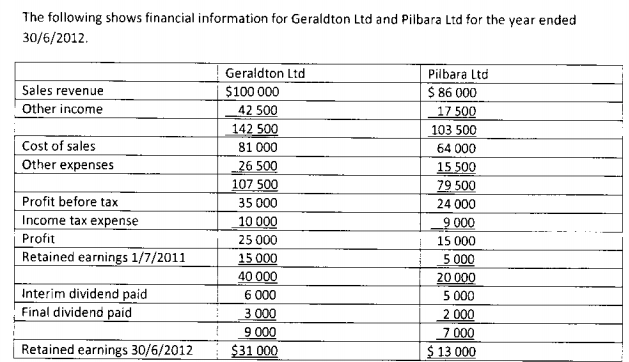

During the year ended 30/6/2012, all inventories on hand at 1/7/2011 were sold. The income tax rate is assumed to be 30%. Also in the current year, Pilbara Ltd sold inventory to Geraldton Ltd for $4000 (cost $2500). One-third of this inventory was on hand at the end of the year.

There were no changes during the year in any element of Pilbara Ltd's equity except for retained earnings.

Required:

(1) Prepare the consolidation worksheet entries necessary for preparation of the consolidated financial statements for Geraldton Ltd and its subsidiary for the year ended 30/6/2012

(2) Prepare the consolidated statement of comprehensive income and statement of changes in equity for Geraldton Ltd and its subsidiary at 30/6/2012.