Mark Miller started his own delivery service, Miller Deliveries, on June 1, 2010. The following transactions occurred during the month of June.

June 1 Mark invested $10,000 cash in the business.

2 Purchased a used van for deliveries for $12,000. Mark paid $2,000 cash and signed a note payable for the remaining balance.

3 Paid $500 for office rent for the month.

5 Performed $4,400 of services on account.

9 Withdrew $200 cash for personal use.

12 Purchased supplies for $150 on account.

15 Received a cash payment of $1,250 for services provided on June 5.

17 Purchased gasoline for $100 on account.

20 Received a cash payment of $1,500 for services provided.

23 Made a cash payment of $500 on the note payable.

26 Paid $250 for utilities.

29 Paid for the gasoline purchased on account on June 17.

30 Paid $1,000 for employee salaries.

Instructions

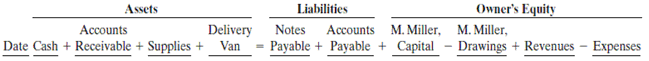

(a) Show the effects of the previous transactions on the accounting equation using the following format.

(b) Prepare an income statement for the month of June.

(c) Prepare a balance sheet at June 30,2010.