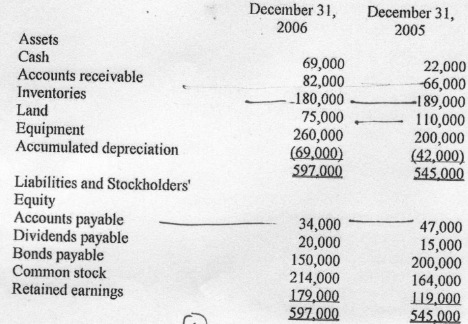

A comparative balance sheet for Omoplata Corporation is presented below:

Net income for 2006 was $115000. Cash dividends of $50,000 were paid. Land was sold at a gain of $ 50,000. The company paid cash for all equipment purchases except for a $40,000 computer that was financed by the issuance of common stock. Omoplata Corporation sold equipment at a loss of $30,000 that had a cost of $70,000 and a hook value of $50,000. The company issued $50,000 of bonds at par during the year and redeemed other bonds for cash.

(a) Prepare a statement of cash flows for the year ended December 31, 2006 along with any related disclosures.

(b) Prepare a statement of retained earnings for the year ended December 31, 2006.