Question

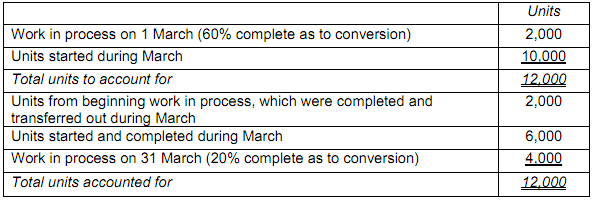

Glass Designs Ltd manufactures decorative glass bowls. The firm employs a process costing system for its manufacturing operations. All direct materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process. The company's production quantity schedule for March 2013 is as follows:

Costs of Work in process (1 March):

- Materials.......................... $ 40,000

- Labour ............................ $ 12,000

- Overhead .........................$ 6,000

Costs added during the month (March) were as follows:

- Materials.......................... $ 200,000

- Labour ............................ $ 76,000

- Overhead .........................$ 38,000

Required:

(a) Prepare a schedule of equivalent units for each cost element for the month of March using the weighted average method.

(b) Prepare a schedule of equivalent units for each cost element for the month of March using the first in first out (FIFO) method.

(c) Calculate the cost (to the nearest cent) per equivalent unit for each cost element for the month of March using the weighted average method.

(d) Calculate the cost (to the nearest cent) per equivalent unit for each cost element for the month of March using the first in first out (FIFO) method.

(e) Determine the cost of ending work in process and the cost of finished goods transferred out during March using the weighted average method.

(f) Determine the cost of ending work in process and the cost of finished goods transferred out during March using the first in first out (FIFO) method.