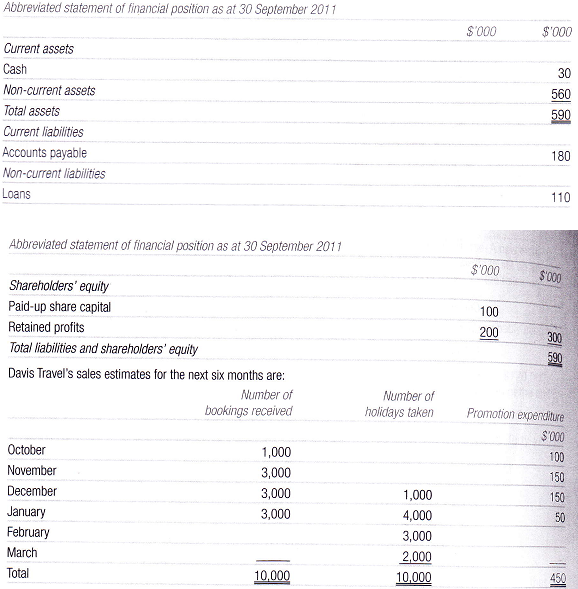

Davis Travel Ltd specialises in short winter sports holidays but also organises outdoor activity holidays in the summer. You are given the

following information:

1. Holidays sell for $300 each-10% is payable when the holiday is booked, the rest is paid after two months.

2. Travel agents are paid a commission of 10% of the price of the holiday one month after the booldng is made.

3. A flight costs $50 per holiday and a hotel costs $100 per holiday. Frights and hotels must be paid for in the month the holidays are taken.

4 Other variable costs are $20 per holiday, paid in the month of the holiday.

5. Administration costs, including depreciation of non-current assets of $42,000, amount to $402,000 for the six months. Administration costs can be spread evenly over the period.

6. Loan interest of $10,000 is payable on 31 March 2012 and a loan repayment of $20,000 is due on that date.

For your calculations, ignore any interest on the overdraft.

7. The accounts payable of $180,000 at 30 September are to be paid in October.

8. A payment of $50,000 for non-current assets is to be made in March 2012.

9. The airline and the hotel chain base their charges on Davis Travel's forecast requirements and hold capacity to meet those requirements.

If Davis cannot fill this reserved capacity, a charge of 50% of costs outlined in note 3 is made. Rewired:

(a)Prepare:

(I) a forecast statement of cash flows for the six months to 31 March 2012

(ii) an income statement for the six months ended on that date

(iii)a statement of financial position as at 31 March 2012.

(b) Discuss the main financial problems confronting Davis Travel. Ignore taxation in your calculations.