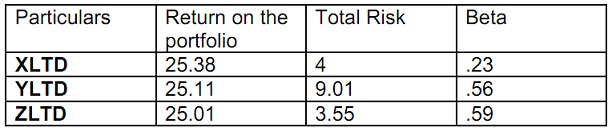

Question 1: The given information is provided regarding the performance of the funds namely X, Y and Z for a period of six months ending August 1999. The risk free rate of interest is supposed to be 9. Rank them with the help of Sharpe Index and describe.

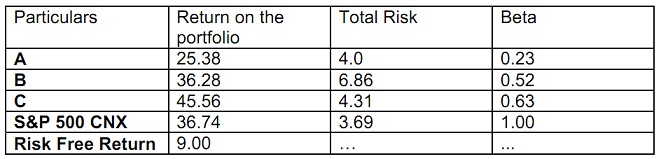

Question 2: The given results were obtained from a study for a period of six months in 2000.

By using the inputs, rank the funds according to the predictive ability of the fund’s management.