American Guitar Company manufactures two different high quality acoustic guitars for retailers: beginner model and professional model. The company has two service departments: the maintenance department and the power department and two manufacturing departments: the construction department and the finishing department. American Guitar selects the reciprocal method to allocate service department costs. It employs operation costing to assign direct materials and conversion costs to its products and absorption costing with normal costs for external reporting purposes.

In the Construction Department, the wooden guitars are built by highly skilled craftsmen and coated with some layers of lacquer. Then the units are transferred to the Finishing Department, where the bridge of the guitar is attached and the strings are installed. The guitars as well are tuned and inspected in the Finishing Department. American Guitar estimates to have an annual practical capacity of 6000 guitars (1500 units of professional model and 4500 units of beginner model). The budgeted sales for 2013 are 1300 units professional model and 4300 units of beginner model. The diagram shown below depicts the manufacturing process.

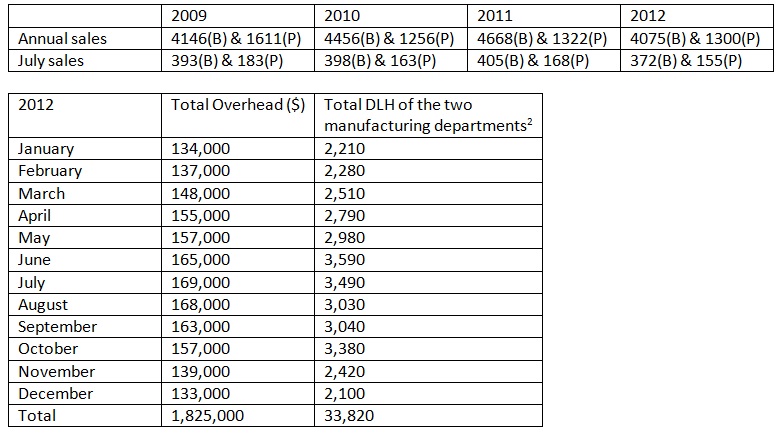

The given historical information has been collected from American Guitar's accounting information systems:

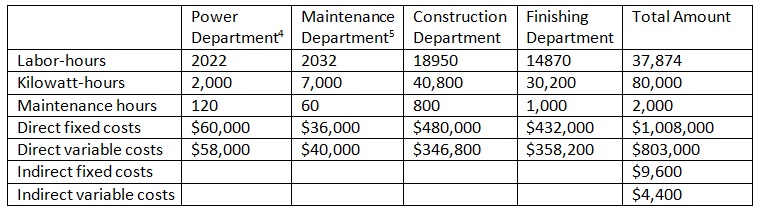

American Guitar’s direct and indirect MOH costs for two service and two manufacturing departments in 2012:

American Guitar doesn't expect important changes in its manufacturing costs in 2013.

At the end of June 2013, the balance in American Guitar’s Materials Inventory account, which comprised 150 pounds of grade A veneered wood, was $2,640; the balance in the finished-goods inventory, which was valuated by using the last-in, first-out (LIFO) method, included of 2 models, was $16,600.

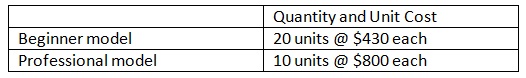

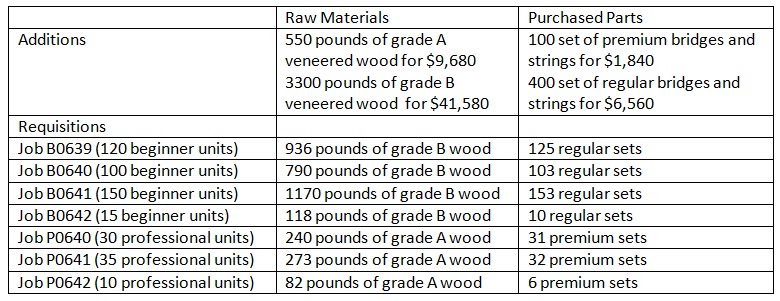

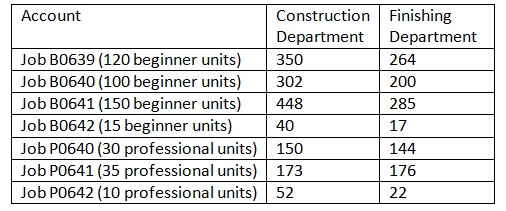

The given pertains to the month of July.

1) There were no beginning inventories in both the manufacturing departments.

2) American Guitar's work-in-process inventory on July 31 consisted of two jobs: B0642 and P0642. The ending WIP inventories at the finishing department for B0642 and P0642 have 10 EU and 6 EU respectively.

3) Additions to and requisitions from the materials inventory throughout the month of July included the following.

4) The average hourly rate for the construction and finishing departments in July was $15 and $14 respectively. The total payroll taxes and fringe benefits rate for American Guitar was 40% of wages paid. The July labor hrs included of the given:

5) 372 beginner models and 70 professional models were sold on account for $600 (beginner model) and $960 (professional model) each. The finished-goods inventory is valuated by using LIFO method.

6) The actual direct fixed costs for power department and maintenance department were $4,050 and $4,000 respectively. The actual direct variable costs for power department and maintenance department were $17,084 and $9,280 respectively.

7) The actual direct fixed costs for construction department and finishing department were $40,100 and $35,800 respectively. The actual direct variable for construction department and finishing department were $33,084.60 and $34,038.40 respectively.

8) Depreciation of general facility and equipment shared by both manufacturing departments throughout July amounted to $12,000.

9) Rent paid in cash for warehouse space used by manufacturing departments throughout July was $1,200. Utility costs incurred for the warehouse during July amounted to $600. The invoices for such costs were received, however the bills were not paid in July.

10) July property taxes on general facility were paid in cash, $2,400.

11) The insurance cost covering factory operations for the month of July was $3,100. The insurance policy had been prepaid.

12) The costs of salaries and fringe benefits for sales and administrative personnel paid in cash throughout July amounted to $8,000.

13) Depreciation on the administrative office equipment and space amounted to $4,000.

14) he other selling and administrative expenses paid in cash throughout July amounted to $35,000.

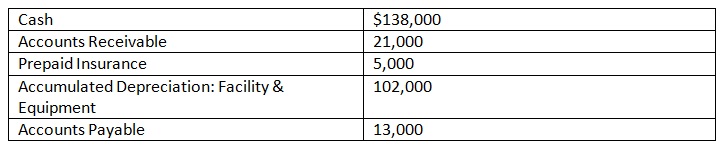

15) The July 1 balances in selected accounts are as shown below:

Required:

Part 1: Make a hard copy of your work to support your computations.

1) What is the predetermined manufacturing overhead rate for external reporting purpose? Is it the most suitable rate for the managerial accounting? Why?

2) Prepare the journal entries to record the transactions in July by using normal costing.

3) Compute the overapplied or underapplied overhead for July. Use the proration technique to prepare a journal entry to close this balance.

4) Prepare a schedule of cost of goods manufactured for July.

5) Prepare a schedule of cost of goods sold for July.

6) Prepare an income statement for July.

7) From the perspective of long-run product pricing, do you recommend American Guitar to keep its absorption costing with normal costs for pricing decision and performance evaluation? Why?

Part 2: Make a hard copy of your work to support your calculations.

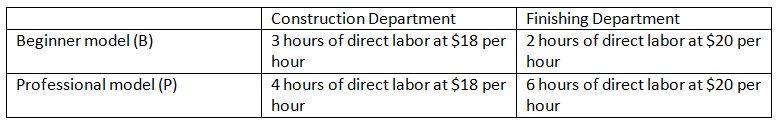

Recently, American Guitar has faced intense competition from oversea guitars manufacturers. Her competitors sell similar quality guitars averaged 25% less. American Guitar considers implementing the standard costing to improve cost control. After conducting task analysis in the manufacturing departments, American Guitar establishes the given standards:

1) Each finished guitar has seven pounds of veneered wood. In addition, one pound of wood is usually wasted in the manufacturing process.

2) The veneered wood used in the beginner model has a standard price of $12 per pound and the professional model has a standard price of $18. The other parts required to complete each beginner guitar (professional guitar), such as the bridge and strings, cost $15 ($18) per guitar.

3) The labor standards for American Guitar's two manufacturing departments are as shown below:

4) Assuming American Guitar implements the standard costing, and compute the followings:

- Direct material and direct labor variances.

- Variable manufacturing overhead variances for both the manufacturing departments in July.

- Fixed manufacturing overhead variances for both the manufacturing departments in July.

- Standard cost for beginner model and professional model.

5) Prepare a journal entries to record the transactions in July by using the standard costing.

6) Prepare entries to close all the variances by using proration method.

7) Do you recommend American Guitar to price its products based on its standard costs? Why?

Prepare a presentation to answer the given questions:

8) Do you recommend American Guitar to keep its present cost-accounting system or to implement the standard costing system? Why?

9) Describe the interpretation and possible interactions between the variances computed by the standard costing.

10) Write a memo to the company evaluating American Guitar’s July performance and indicate any suitable action for management to fine-tune its strategy.