Problem:

You are a member of ALM Committee (ALCO) of ANZ Bank. A visiting member has some queries relating to general framework of ALM and interest rate risk impact on the income statement of the bank. You have been assigned the task of drafting a response to each of them. The queries are as follows:

Required:

(a) In brief define Asset and Liability Management (ALM) concept for the commercial bank.

(b) In brief outline the objectives and aims of ALM.

(c) Illustrate out what the main issues are considered by the ALM committee in a bank.

(d) Write down the different sources of risks which are encountered by the commercial bank?

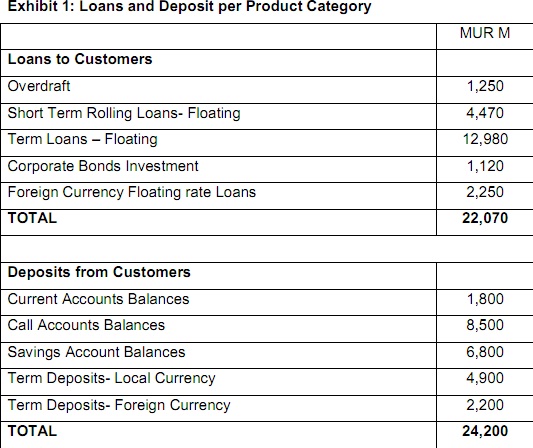

(e) In view of the forthcoming Monetary Policy Committee of Central Bank, there is speculation of a possible reduce in the repo rate by 75 basis points. Exhibit 1 provides a snap shot of the breakdown of loans to customers and deposit from customers per product category.

Calculate the potential incremental gain or loss in terms of interest income to ANZ Bank following the speculated increase of 75 basis points in repo rate causing ANZ to increase its savings rate by 50 basis points and Prime Lending Rate (PLR) by full 75 basis points.