Question 1: Illustrate the steps in the traditional approach?

Question 2: Describe the constraints in the formation of objectives.

Question 3: How would you prepare the asset mix according to the given objectives?

Question 4: Illustrate the differences between the traditional approach and modern approach?

Question 5: State the modern approach in the construction of portfolio.

Question 6: Consider two situations: a young man X in early twenties and the other young man Y in the late thirties X and Y earns similar amount of money. Mr. Y has a family, a house, a car and all the encumbrances associated with the marital status. Both of them like to invest in securities, what would be their constraints and major objectives?

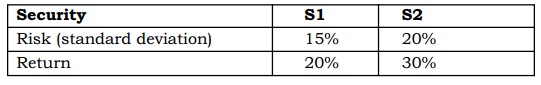

Question 7: Calculate the risk and return of a portfolio of such securities. Suppose equal weights.

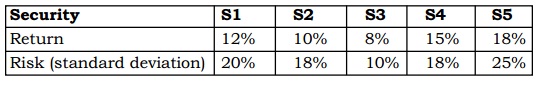

Question 8: Provide the minimum risk portfolio from the combination of the given securities.