Aristo Ltd. employs a system of absorption costing. The product passes via a machining department and an assembly department before it is completed. The machining department is capital intensive; and the assembly department is labor intensive.

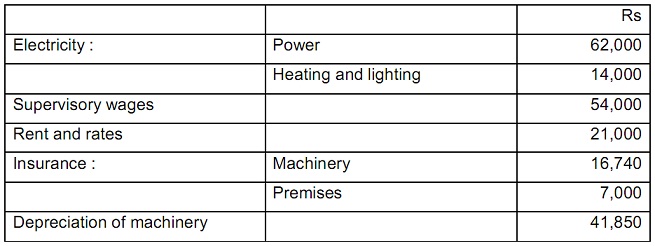

The company’s cost accountant has estimated the given overhead costs for the financial year ended 31 May 2010.

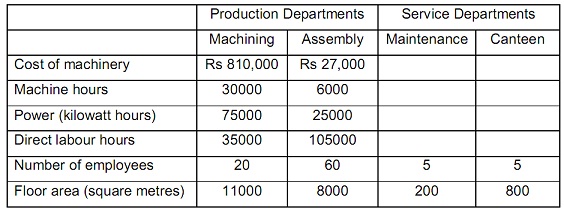

The given information must be used to find out the suitable basis of apportionment for the year.

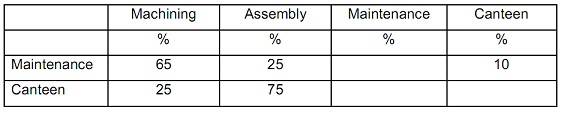

The proportion of work done by the service departments is estimated to be:

It is the company policy to apportion the maintenance department’s costs between the other three departments to remove those costs before apportioning the canteen costs between the production departments.

Required:

a) Make a statement to exhibit the total production overheads for each production department, exhibiting the basis of apportionment chosen.

b) Compute an overhead absorption rate for each production department, by using the most appropriate basis of absorption.

c) Determine the Activity Based costing and how does it dissimilar from the traditional absorption costing?

d) Describe in brief four differences between the financial and management accounting.