Question:

a) Most of the companies attempt to maintain sustained instead of fluctuating cash dividend per share payment. The payment is gradually adjusted to changes in earnings over time. As an effect, corporations apparently establish a target payout ratio range.

Required:

Describe why corporations desire sustained cash dividends per share with a rising trend and attempt to avoid fluctuating cash dividend payments.

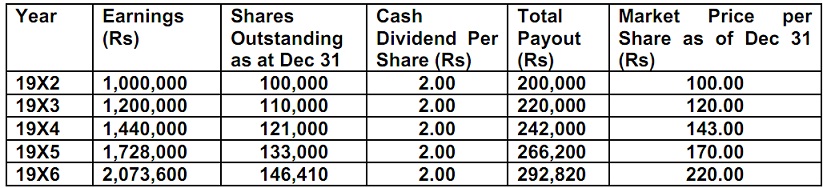

b) The Mauviglaze Company has experienced rapid growth in the past five years. In order to finance the growth, the board of directors has followed by a policy of controlled borrowing, a low dividend payout ratio and a regular stock dividend.

The proportion of debt in the capital structure has remained constant since 19X0. The funds produced from the operations have been reinvested in productive assets. Each January, for the past four years, Mauviglaze’s board of directors has declared and honored a 10 % stock dividend. A Rs 2.00 per share cash dividend on the stock outstanding on June 15 has been paid each July for the past five years. Management estimates that the earnings for 19X7 will be Rs 2,500,000. The closing price of Mauviglaze Company’s stocks at November 30, 19X7 was Rs 255.00 per share.

The board anticipates a challenge to its intention to carry on this dividend policy by two stockholders who are survivors of the founders. Chosen data related to the company’s earnings and dividends are presented in the given table:

Required:

i) Prepare a response from the perspective of Mauviglaze Company’s board of directors which justifies the low cash dividend payout.

ii) Make a brief description from the perspective of the two stockholders challenging the company’s dividend policy.