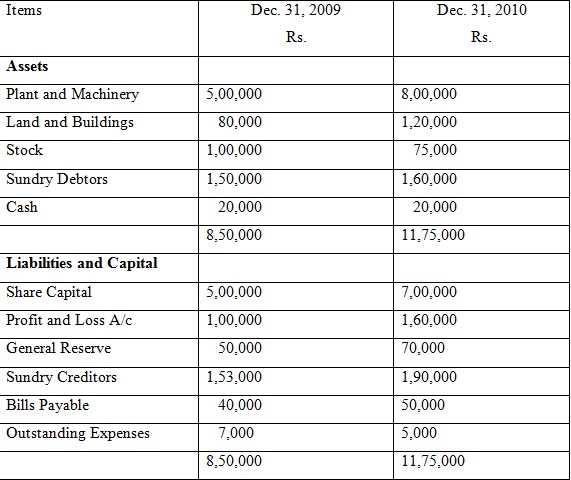

1. The Balance Sheet of Bharat Machinery Pvt Ltd., as on December 31, 2009 and 2010 are as follows:

Extra Information

(i) Depreciation of Rs. 50,000 has been charged on the Plant and Machinery throughout the year 2010.

(ii) A piece of machinery was sold for Rs. 8,000 throughout the year 2010. It had cost Rs. 12,000, depreciation of Rs. 7,000 had been provided on it.

Make a schedule of change in working capital and a statement demonstrating the sources and application of funds for the year 2010.

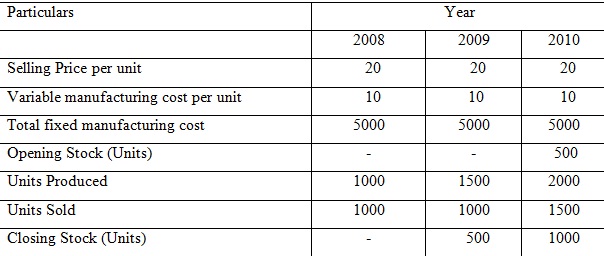

2. From the following cost, production and sales data of Decors Motor Ltd make comparative income statement for three years under (i) absorption costing method, and (ii) marginal costing method. Indicate the unit cost for each year under each method. Also appraise the closing stock. The company produces a single article for sale.

3. From the subsequent information related to XYZ Ltd.; you are required to find (a) contribution (b) Break-even point in units (c) Margin of safety, (d) Profit

Total Fixed Costs Rs.6, 000

Total Variable Costs Rs.20, 000

Total Sales Rs.32, 000

Units Sold 4,000 Units

Also calculate the volume of sales to earn profit of Rs. 12,000.

4. Write brief notes on the following:

a) Performance budgeting

b) Zero base budgeting

c) Factors affecting dividend decisions

d) Accrual concept

5. What is capital structure? Elucidate the features and determinants of an appropriate capital structure.