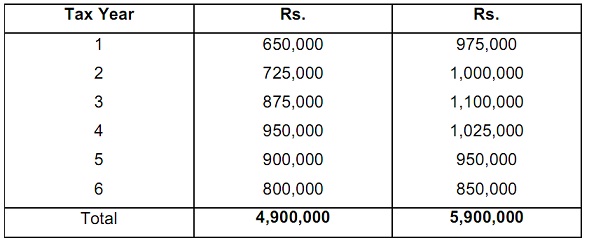

Question 1: An Organization is considering two mutually exclusive proposals to install new milling controls. The cost of proposal A is Rs 2,700,000 and proposal B is Rs. 3, 000,000. The projects have a life expectancy of 6-years each and no salvage value. The tax rate is 50%. Suppose the firm uses straight line method of depreciation and the same is permitted for tax purposes. The estimated cash flows before depreciation and tax (CFBT) from the investment proposal are as shown below:

Required: Calculate the given:

a) Payback period

b) Average Rate of Return

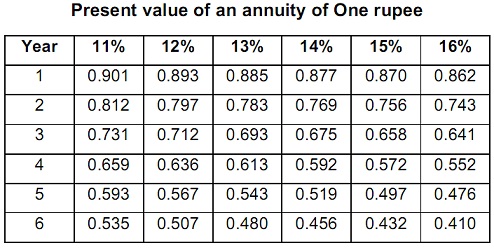

c) Net present value @ 15%

d) Profitability Index

e) Propose which project must be adopted by the company

Question 2: The management of an organization is considering opening a new plant. Assess the usefulness to management of both the payback period and net present value methods of investment appraisal when deciding where to locate the new plant.