Question 1:

(A) Distinguish between application and monitoring controls and give an example of each.

(B) Outline and explain the financial statement assertions.

(C) What is meant by professional skepticism?

(D) Outline the steps you would take to audit a bank reconciliation statement.

(E) State any three types of audit evidence gathering techniques and set out which would be regarded as the most reliable and why.

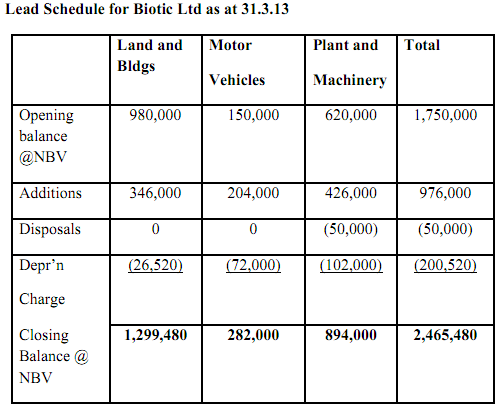

Question 2: You are an associate auditor with Great Partners and you have been asked to take responsibility for the audit of non current assets of Biotic Ltd (Biotic). Biotic has prepared its financial statements for the year ended 31.3.13. Your Audit Manager has presented you with the Lead Schedule as prepared by Biotic's accountant (see below) as well as a trial balance. It is Biotics company policy to charge a full year's depreciation in the year of acquisition and none in the year of disposal. Land and Buildings are depreciated at 2% reducing balance, Motor Vehicles at 20% reducing balance and Plant and Machinery at 10% reducing balance.

REQUIREMENT:

(a) What is a Non Current Asset/ Fixed Asset Register and outline the steps that you as an auditor can take to confirm the accuracy of the register.

(b) Outline the audit procedures you would take to confirm the disposals to non current assets during the accounting period.

(c) Using Biotic's Lead Schedule provided above, describe the audit work you would conduct on non current assets (excluding tests on disposals in part (b).

(d) Outline briefly how you might assess the depreciation policy of Biotic Ltd.

Question 3:

You are the audit senior in the audit of Sonner plc (Sonner) a company which holds investments in a number of companies involved in the retail industry. Sonner is listed on the London Stock Exchange. During the year, Sonner purchased a portfolio of additional investments, including both listed and non listed investments in managed funds. You have just received an email from the Audit Manager outlining certain points that you need to consider in advance of the audit planning meeting which takes place with her tomorrow. Sonner has a 31 December 2013 year end and the company has made a loss for each of the last three years.

REQUIREMENT:

(a) Set out the key steps you would follow to plan the audit of Sonner.

(b) Based on the detail provided, identify the significant issues which should be considered as part of the audit planning process for Sonner.

(c) The audit assistant that was due to assist you on the audit has recently indicated that he had invested in shares issued by Sonner but has indicated that these will be disposed of before the audit assignment is complete. Outline any independence issues you consider relevant and any recommendations that you would propose.

(d) Identify and critically analyse different methods of selecting an audit sample.