Part A Theory Questions.

Answer all the questins. Be thorough, yet concise.

Question1) What are some ways that customers affect the firm’s costs?

Question2) What is an objective of joint cost allocation?

Question3) When would you advise the firm to use direct intervention to set transfer prices?

Part B Problem Material.

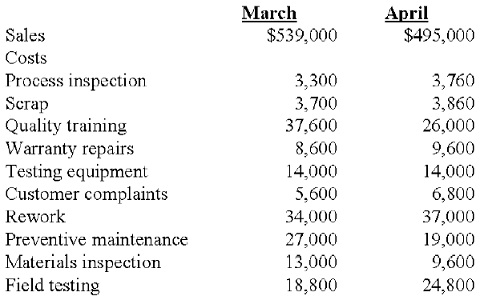

Question1) The following represents the financial information of Trovatore Corporation, a manufacturer of electronic components, for two months:

Required

a) Classify these items into prevention, appraisal, internal failure, or external failure costs.

b) Calculate the ratio of the prevention, appraisal, internal failure, and external failure costs to sales for March and April.

Question2)

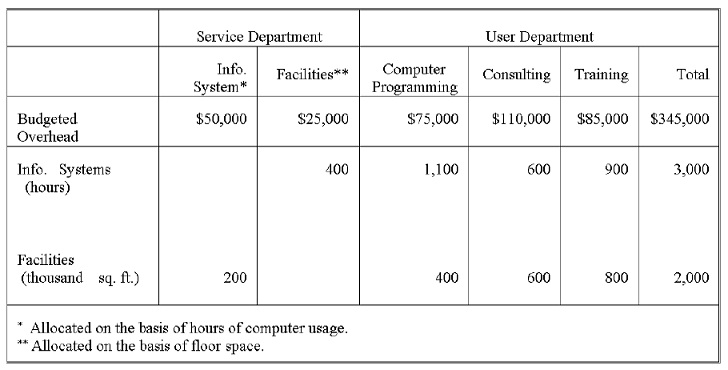

Computer Information Services is a computer software consulting company. Its three major functional areas are computer programming, information systems consulting, and software training. Carol Birch, the pricing analyst in an Accounting Department, has been asked to develop total costs for functional areas. These costs will be used as the guide in pricing new contract. Birch assembled the following data on overhead from its two service departments, the Information Systems Department and the Facilities Department.

Required: Allocate the service department costs to the user departments using the step method.

Question3)

Meredith Motor Works has just acquired the new Battery Division. Battery Division produces a standard 12volt battery that it sells to retail outlets at a competitive price of $20. Retail outlets purchase about 600,000 batteries a year. Since the Battery Division has a capacity of 1,000,000 batteries a year, top management is thinking that it may be wise for company's Automotive Division to start purchasing batteries from the newly acquired Battery Division.

Automotive Division now purchases 300,000 batteries a year from the outside supplier, at a price of $18 per battery. Discount from the competitive $20 price is a result of the large quantity purchased.

The Battery Division's cost per battery is shown below:

*Based on 1,000,000 batteries.

Both divisions are to be treated as investment centers, and their performance is to be evaluated by the ROI formula.

Required:

a) What transfer price would you recommend and why?

b) What transfer price would you recommend if the Battery Division is now selling 1,000,000 batteries a year to retail outlets?

c) Refer to (a) Top Management has decided the transfers between the two divisions should be at $19. Compute the effect of the transfer on the net income for a Battery Division, Automotive Division, and the total company.

Question4)

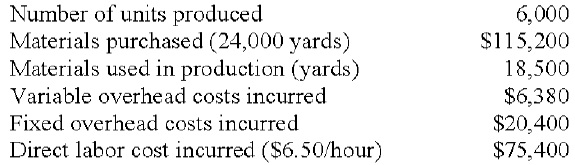

XYZ Company uses the standard cost accounting system and estimates production for 2007 to be 60,000 units. At this volume, company's variable overhead costs are $.50 per direct labor hour.

Company's single product has the standard cost of $30.00 per unit. Included in the $30.00 is $13.20 for direct materials (3 yards) and $12.00 of direct labor (2 hours). Production information for the month of March 2007 follows:

Required:

(Be sure to indicate whether variances are favorable or unfavorable.)

a) Prepare the standard cost sheet for company.

b) Compute direct material price variance, assuming material price variance is a responsibility of the company's purchasing agent.

c) Prepare the journal entry to record the purchase of direct materials.

d) Compute direct labor efficiency variance.

e) Compute budgeted fixed overhead costs for the month and for the year.

f) Compute fixed overhead volume variance.