Question 1:

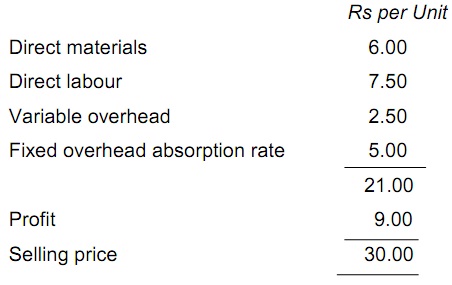

a) A company produces and sells a single Product, Z. Cost and selling price details for the product are as shown below:

Budgeted production for the month was 5,000 units though the company managed to produce 5,800 units, selling 5,200 of them and incurring fixed overhead costs of Rs 27,400.

Required: Compute the marginal and absorption costing profit for the month.

b) Marginal costing and absorption costing are different methods for assessing profit in a period.

Reported profit figures by using marginal costing or absorption costing will vary if there is any change in the level of inventories in the period. If production is equivalent to sales, there will be no difference in computed profits by using the costing techniques.

Required: Describe the validity of this statement, validating the reasons why you might agree or disagree with it.

Question 2:

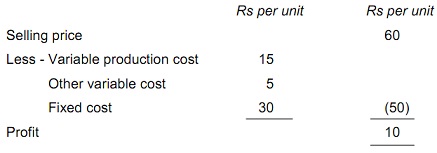

a) An organization produces and sells a single product. At the budgeted level of output of 2,400 units per week, the unit cost and selling price structure is as shown below:

Required: Determine the breakeven point (in units per week)?

b) A company produces one product that it sells for Rs 40 per unit. The product has a contribution to sales ratio of 40%. Monthly total fixed costs are Rs 60,000. At the planned level of activity for the next month, the company has a margin of safety of Rs 64,000 expressed in the terms of sales value.

Required: Determine the planned level of activity (in units) for the next month?