Question 1

ACTIVITY BASED COSTING

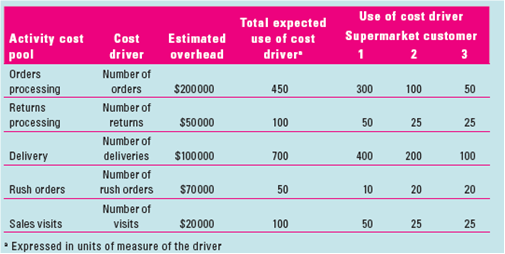

The Cheesecake Company supplies cheesecakes to three large supermarket chains throughout Australia. Management has become concerned about the rising costs associated with the processing and dispatch of orders. An activity analysis of theoverhead identified the following customer related costs:

Required

a. Calculate the cost rate for each activity

b. Calculate the cost of each activity for the three supermarkets

Question 2

STANDARD COSTING

Lux Pty Ltd produces a single product, The company uses a standard costing system. Based on producing 15500 units of product per month, the standard cost specification

for one unit of product is as follows:

The Standard Cost $

Direct Material 5kg @ $0.25 per kg 1.25

Direct Labour 40 minutes @ $12.00 per hour 8.00

Factory overhead 1.5 hours @ $16.00 per machine hr 24.00

33.25

The standard variable factory application rate was $10.00 per machine hour.

Actual results for July were:

Materials purchased 80,000kg at a cost of $19,200

Materials issued to production (used in production) 73,800kg

Direct Wages paid 9,950 hours at $11.85 per hour

Actual machine hours 22,200

Actual Factory Overhead incurred $310,750

Actual production 15,350 units of product

Materials Price variance is based on issued material(not on purchased material)

Required: Calculate all seven variances, and the Total Direct Material, Direct Labour and Overhead Variances.