Problem 1. Consider the following labor market for some economy: labor demand is given by w = 170 – 3L whereas supply of labor is characterized by the equation w = 30 + L . In this setting w and L are the nominal wage rate per week and the number of hours worked per week, respectively.

(a) Suppose we have full employment, what is the equilibrium level of L and w?

(b) Assume that the aggregat e production function is Y = 5K0.5L0.5 where K is physical capital. Additionally suppose this economy possesses an endowment of capital, K0 = 100, and furthermore assume this economy always produces at full capacity. What is the full employment output for this economy? (Y is real GDP, K is capital, and L is labor.)

(c) What is the labor productiv ity if the economy produces the full employment level of output?

(d) Suppose now, that the government implements a minimum wage rate of $70 per week.

(d.1) Given this information, what is the number of unemployed in this economy?

(d.2) Given this information, what is the new level of output for this economy and the new level of labor productivity?

(d.3) From your answers in parts (d.1 and d.2), discuss wh ether or not the government minimum wage policy makes workers better off or not?

(e) Go back to the initial situation (no minimum wage imposed by the government). Suppose the amount of available physical capital increases to K=125. Suppose there is no change in labor demand and labor supply. Given this change in capital, what is the full employment level of out put and what is labor productivity? How does an increase in the capital stock affect output and labor productivity?

Problem 2. For each of the following situations use a graph of both the labor market and a graph of the aggregate production function to analyze the situation (the se vertically stacked graphs were presented in class). Provide a clear explanation and be su re to identify the effects on the level of employment, the wage rate, the output level and the level of labor productivity.

(a) The average education level has increased. Assume that this change does not alter either the labor demand or the labor supply curves.

(b) The level of capital in the economy cha nges while the demand and supply of labor is unaffected.

(c) An immigration wave takes place (i.e. the labor force increases).

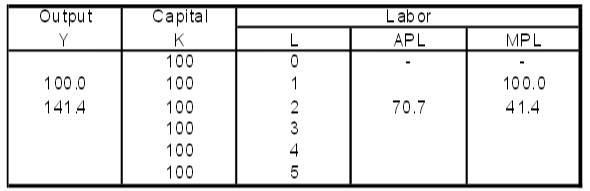

Problem 3. Complete the following table. Th e production function is given by Y = 10K0.5L0.5 where capital is fixed at the level K= 100. APL stands for average productivity of labor while MPL stands for marginal productivity of labor (ΔY/ΔL).

Problem 4. Consider the following economy:

The business sector has an investment function: r = 25 – I/2000

The household sector has a saving functi on: r = - (1/2) + SP/4000

Also, by definition, we have the following equations:

Y = C + I + G + X - IM

SP = Y - C – T + TR

SG = T – TR - G

KI = IM - X

where C = Consumption, SP = Private Saving I = Investment, SG = Government Saving G = Government spending, T = Tax, X = Export, TR = Government Transfers, IM = Import, KI = Capital Inflow, r = real interest rate in percentage tem.

Answer the following questions.

(a) Write an equation for National Saving (NS), and indicate all the components in NS. (Note: National Saving equals the sum of private saving and government saving).

(b) In equilibrium, we know that investme nt equals national saving plus capital inflows. Using the equations above, provide a proof about the identity.

(c) Consider a country whose economy is a closed economy. Furthermore, assume initially that government saving in this economy is zero. Use the information above to find

(1) the equilibrium interest rate,

(2) the equilibrium level of investment,

(3) the equilibrium level of private saving and

(4) the equilibrium level of national saving.

(d) Suppose in this closed economy the government decides to increase its spending so that it will have a budget deficit of 12,000 (i.e., S G = - 12,000). Find (1) the equilibrium interest rate, (2) the equ ilibrium level of investment, (3) the equilibrium level of private saving and (4) the equilibrium level of national saving.

(e) How does the government’s decision to increase its government spending affect the equilibrium level of investment, the equilibrium level of private saving, and the real interest rate?

(f) Suppose this country continues to ha ve a budget deficit of 12,000. Suppose the government decides to trade with other c ountries and its capital inflows are equal to $6000 (i.e., KI = 6,000). Find (1) the equilibrium intere st rate, (2) the equilibrium level of investment, (3) the eq uilibrium level of private saving and (4) the equilibrium level of national saving.

(g) How does this capital inflow affect the equilibrium level of investment, the equilibrium level of privat e saving, and the real interest rate in this open economy?

Problem 5. Use the market for loanable funds to answer the following questions:

(a) Suppose that the government wants to reduc e the size of its surplus to zero by increasing its spending. Use a graph of the loanable funds market to explain what happens to private savings, equilibrium level of investme nt, and equilibrium interest rate.

(b) Assume the budget balance is zero. Suppose that at any given interest rate, consumers decide to save less. Use a graph of the loanable funds market to explain what happens to the equilibriu m level of investment and equilibrium interest rate.

(c) Assume the budget balance is zero. Suppose that at any given interest rate, businesses become very pessimistic about the future profitability of investment. Use a graph of the loanable funds market to explain what happens to private savings and the equilibrium interest rate.

(d) Suppose the equilibrium level of investment is exactly equal to the depreciation of the economy’s capital each year. Holdin g everything else constant, the government decides to decrease its level of spending. Suppose this decrease in government spending has no effect on th e equilibrium level of employment. What is the effect of this decrease in government spending on output and capital productivity (output per unit of capital)?