Question 1: A company projects production of 10,000 units which will need 3 hours of direct labor to produce each item. Direct labor costs are $15 per hour (standard rate). The actual job needs 32,000 hours to produce 9,500 units at a labor cost of $528,000. Determine the labor efficiency variance?:

a. $42,750 unfavorable

b. $48,000 unfavorable

c. $52,500 unfavorable

d. $57,750 unfavorable

Question 2: Which of the given would raise the cash flows from operating activities (all other things equal):

a. A decrease in long-term debt

b. An increase in long-term debt

c. An increase in accounts receivables

d. An increase in accounts payables

Question 3: A company takes 25 days to sell the average piece of inventory. It takes another 18 days to collect a receivable. It takes 20 days to pay accounts payable. Find out the cash conversion cycle for this company:

a. 23 days

b. 43 days

c. 45 days

d. 63 days

Question 4: A company started the year with $55,000 in inventory. Throughout the year, the company bought other $400,000 in inventory. The company ends the year with $65,000 in inventory. Sales for the period were $575,000. On average, how long does it take for the company to sell an item of inventory? Suppose 365 days in a year:

a. 54.8 days

b. 56.2 days

c. 59.3 days

d. 61.8 days

Question 5: A company started the year with $525,000 in accounts receivable and ended the year with $400,000 in accounts receivable. Throughout the year, the company made credit sales of $8,500,000. How long on average did the company take to collect its accounts receivable throughout this period? Suppose 365 days in a year:

a. 17.2 days

b. 19.9 days

c. 22.5 days

d. 29.8 days

Question 6: If the merchandise inventory at the end of the year is overstated by $10,000, the error will cause an:

a. Overstatement of cost of merchandise sold for the year by $10,000

b. Understatement of gross profit for the year by $10,000

c. Overstatement of net income for the year by $10,000

d. No impact on income statement

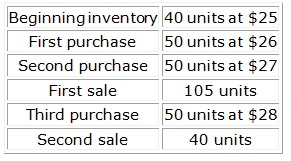

Question 7: The given units of a particular item were purchased and sold throughout the period:

What are the unit cost(s) of the remaining units on hand at the end of the period as determined by the LIFO costing method:

a. $25

b. $28

c. $25 and $26

d. $25 and $28

Question 8: If merchandise inventory is being valued at cost and the price level is steadily increasing, the method of costing which will produce the lowest net income is:

a. Average

b. FIFO

c. LIFO

d. Periodic

Question 9: Which of the given assets doesn't get depreciated:

a. Buildings

b. Equipment

c. Land

d. All of the above get depreciated

Question 10: Find out the amount of depreciation, by using the sum-of-the-years-digits method, for the first year of use for equipment costing $17,500, with an estimated residual value of $1,000 and an estimated life of 4 years:

a. $4,125

b. $4,375

c. $6,600

d. $7,000